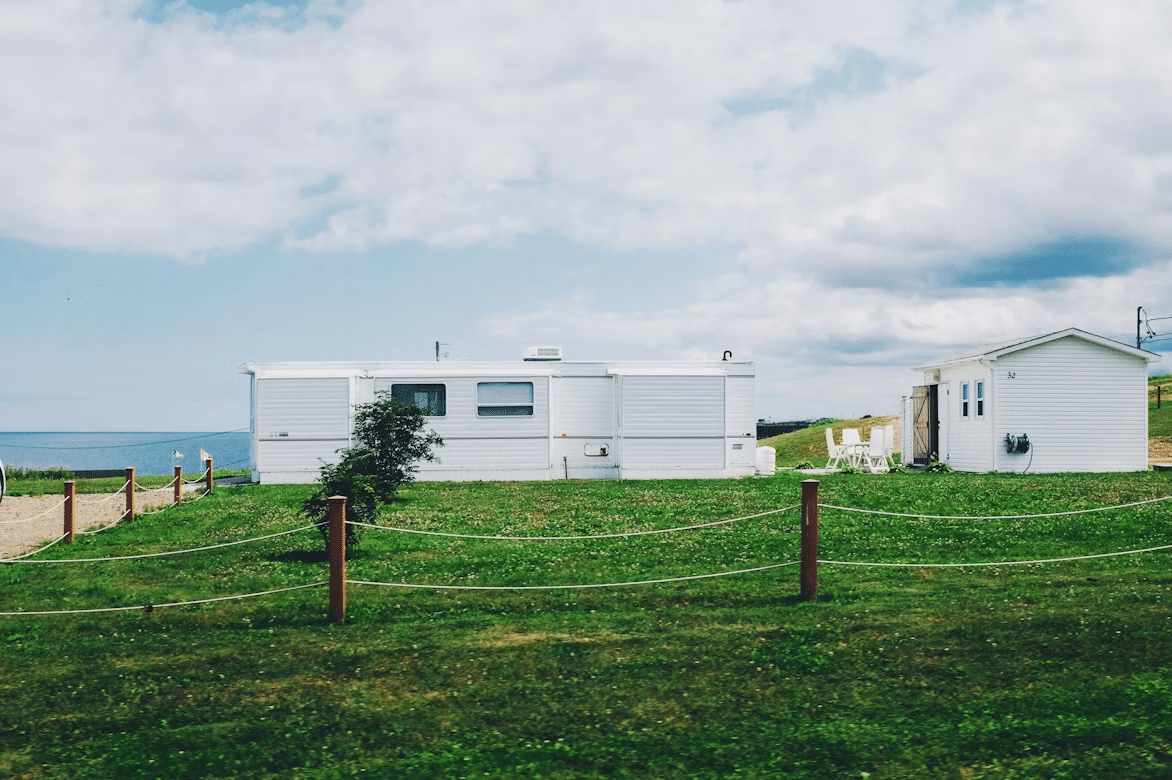

Selling a mobile or manufactured home can feel complicated at first. With a simple plan and the right paperwork, you can move from decision to closing without stress. Keep on reading to learn more!

Choose your selling path

Start by deciding who fits your timeline and condition. Many owners prefer working with Palatka mobile home buyers mid-transaction to avoid showings and lengthy repairs, then finish paperwork in one sitting. If you want top dollar and can wait, list retail and allow for inspections and financing steps.

Price for what you keep, not just the sticker

Think in net terms, not just asking price. A federal rule lets many sellers exclude a large amount of gain on a primary residence, and the IRS explains that qualifying owners may avoid income tax on up to $250,000 in gain or $500,000 for joint filers. If you qualify, plan around those thresholds so your sale does not create an avoidable tax bill.

Know Florida’s transfer taxes

Build state taxes into your net sheet before you sign. Florida’s revenue department notes that most counties charge a documentary stamp tax on deeds at 70 cents per $100 of the sale price, so a $100,000 transfer means a $700 line item. When you expect this cost, you will not need to renegotiate late or chase surprise credits at closing.

If your home sits on a rented lot, loop in the park early

Sales inside land-lease communities often require park approvals. Florida’s mobile home statute outlines how prospectuses and disclosures work for lot rentals, which shapes the steps a buyer must complete before they can take possession. Ask management about application timing, income checks, and move-out rules so your buyer does not stall at the gate.

Share the right documents

Deliver the community rules, prospectus, and the buyer’s lot application as soon as you go under contract. Clear expectations keep timelines tight.

Get titles and IDs right the first time

Your closing speed depends on clean titles. Florida’s highway safety agency spells out that mobile home titles should be processed on the correct mobile-home application, so verify VINs and decal numbers before you visit the tax collector. Bringing accurate forms saves you from repeat trips and last-minute delays.

Confirm how the home is classified for taxes

Mobile homes are taxed differently depending on their status. Putnam County’s tax office notes that the tangible personal property tax can apply to structural additions like porches or carports, so check for any outstanding assessments before you promise a quick close. If the home has been retired to real property, the tax treatment and closing documents will look more like a site-built sale.

Pick repairs that speed the deal

You do not need a full makeover to sell fast. Focus on safety and water issues first, since those are common hangups for buyers and parks.

- Fix soft flooring at entries and kitchens

- Seal roof edges and any active leaks

- Test GFCIs, smoke alarms, HVAC, and water heater

- Tighten skirting and secure steps

- Remove debris and haul old appliances

Use a short, plain-English contract

Simple contracts close quicker. Keep the inspection window short, define escrow and access clearly, and outline who pays which routine costs. Florida’s budget analysts highlight the documentary stamp tax as a steady source of general revenue, which signals these fees are standard and rarely waived, so set expectations early when you negotiate credits.

Coordinate timing when land is included

If the home is retired to the land, you will convey by deed and handle traditional title work. That usually means clearing liens, verifying legal descriptions, and confirming whether any mobile home titles were properly retired. One state procedure update explains how authorization letters and the correct mobile-home title application speed processing when a formal title is needed, so ask your title agent to check the status before you schedule closing.

Plan your one-visit closing kit

You can often finish everything in a single appointment if you prep a week ahead. Bring government ID, payoff letters, park approval, and a clean title or the correct application form if a new title must be issued. The state’s tax agency also publishes guidance that mobile homes may be taxed as real property, by decal, or as tangible personal property, so confirm your category to avoid last-minute surprises on the HUD or settlement statement.

Selling a pre-manufactured residence gets easier when you focus on net proceeds, park coordination, correct forms, and a short repair list. With a clear plan and the right buyer fit, you can wrap up the sale and move on without extra hassle.