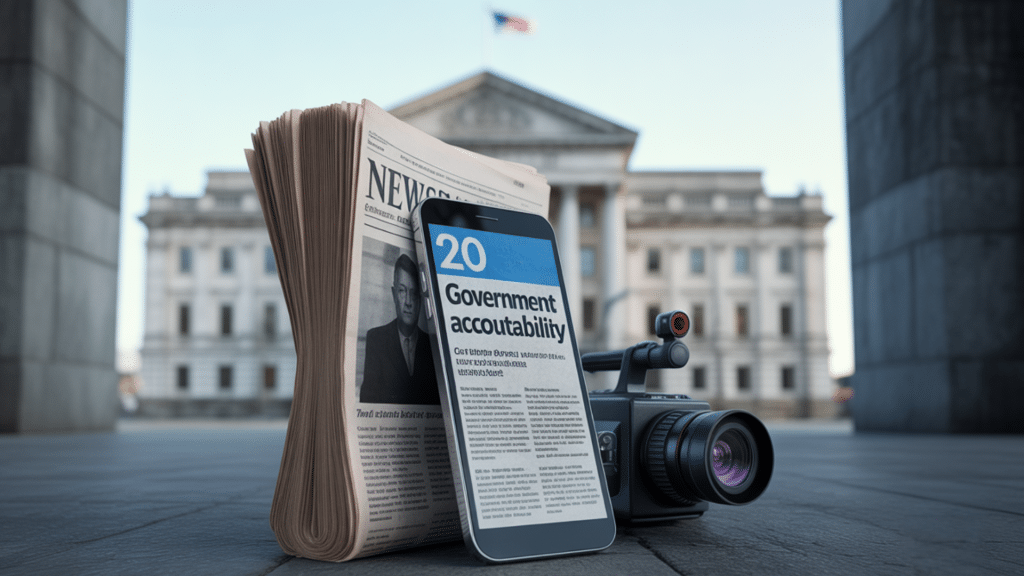

Daniel E. Kaplan, in his career, approaches insurance as a structural element of organizational stability rather than a transactional safeguard. In the aftermath of a disaster, continuity is rarely determined by the severity of the event alone.

Outcomes are shaped by the clarity of preparation, the alignment of coverage with operational reality, and the discipline applied during recovery. Insurance, when properly structured and actively managed, provides the financial and strategic framework that allows organizations to preserve value and maintain operations under adverse conditions.

Disasters place immediate strain on physical assets, but their most significant consequences are operational and financial. Buildings, equipment, inventory, and infrastructure form interconnected systems that support revenue, workforce stability, and customer confidence.

When those systems are disrupted, recovery requires access to capital, informed decision-making, and protections designed to function under stress. Insurance plays a central role in that equation.

Viewing Property as an Integrated Operational System

Effective insurance planning begins with a comprehensive understanding of property as an operational system. Physical assets do not exist in isolation. Each component supports a specific function within the organization, and damage to one element can impair the entire operation.

A facility may remain structurally intact while specialized equipment, climate controls, or data systems are compromised. Inventory losses may interrupt production schedules or contractual obligations even after repairs are completed. Insurance programs that focus narrowly on replacement cost without addressing these dependencies often fall short of supporting full recovery.

“Coverage design should reflect how assets are used rather than how they are categorized on a balance sheet,” says Daniel E. Kaplan. “Identifying which possessions are critical to continuity allows organizations to align limits, endorsements, and supplemental coverages with actual exposure.”

Insurance as a Mechanism for Financial Continuity

Following a disaster, liquidity becomes a decisive factor. Repair costs, temporary relocation, equipment replacement, regulatory compliance, and workforce retention all require funding at a time when revenue may be reduced or temporarily suspended.

Insurance proceeds provide access to capital when external financing may be constrained. Understanding how to secure timely reimbursement on property insurance claims allows organizations to move forward with repairs, secure alternative operating arrangements, and maintain payroll without resorting to disruptive cost-cutting measures.

The ability to act quickly often determines whether an organization maintains its market position during recovery. Insurance also influences stakeholder perception.

Lenders, investors, customers, and employees assess preparedness through the lens of response. A well-executed insurance program signals stability and foresight, reinforcing confidence at a time when uncertainty is elevated.

Precision in Coverage Design and Policy Understanding

One of the most persistent challenges in disaster recovery arises from misalignment between perceived and actual coverage. Policy language governs outcomes, and its implications become clear only under loss conditions.

Kaplan stresses the importance of policy fluency at the leadership level. Coverage limits, deductibles, exclusions, valuation methods, and waiting periods all materially affect recovery. Hurricane deductibles, flood exclusions, and sublimits for specific property classes can significantly alter financial exposure if not fully understood.

Notes Kaplan, “Coverage distinctions matter. Loss of use, extra expense, and contingent business interruption respond differently depending on policy structure.”

Organizations that understand these mechanisms in advance are better equipped to plan for downtime and allocate resources effectively. Treating policy review as a strategic exercise rather than an administrative task reduces the likelihood of surprises and strengthens recovery planning.

Business Interruption as a Determinant of Survival

In many cases, the most significant losses associated with a disaster stem from operational interruption rather than physical damage. Business interruption coverage is designed to address this exposure, but its effectiveness depends on preparation and documentation.

Interruption claims require disciplined substantiation. Establishing loss involves demonstrating what operations would have produced under normal conditions. Historical financial records, production data, customer contracts, and expense schedules form the foundation of this analysis.

Organizations that maintain accurate records and integrate finance teams early in the claims process are better positioned to secure appropriate recovery support. Interruption coverage can sustain payroll, preserve customer relationships, and prevent permanent closure during extended recovery periods. Its value, however, is realized only when coverage terms align with operational realities.

Claims Management as a Strategic Function

Large or complex insurance claims require active oversight. Claims management is a strategic function that demands coordination across departments and external advisors.

“Governance is vital during the claims process. Clear documentation, consistent communication, and structured follow-up reduce delays and disputes. Reviewing adjuster assessments carefully, reconciling estimates with operational impact, and providing supplemental information when necessary support equitable outcomes,” says Kaplan.

Protecting Financial and Human Capital

Beyond physical assets, disasters place pressure on financial reserves and workforce stability. Liquidity planning is essential to sustaining operations during prolonged recovery. Access to contingency funding allows organizations to address repairs, upgrades, and continuity measures without compromising strategic objectives.

Human capital protection is equally critical. Employees affected by disaster seek stability and clear communication. Organizations that prioritize workforce support during recovery tend to retain talent and maintain morale, preserving institutional knowledge and productivity.

Insurance supports these efforts indirectly by providing the financial flexibility needed to prioritize people alongside property. The ability to maintain payroll and benefits during disruption reinforces trust and supports long-term organizational health.

Preserving Organizational Reputation and Market Position

Recovery speed influences reputation. Customers and partners assess reliability based on how organizations respond under pressure. Prolonged closure or inconsistent communication can erode confidence, while disciplined recovery reinforces credibility.

Insurance enables organizations to address immediate needs while planning strategically for reopening. Temporary facilities, expedited repairs, and operational adjustments are often possible only with adequate financial support. Maintaining visibility and service continuity protects market position and customer loyalty.

Reputation is an asset indirectly protected through insurance-enabled continuity. The ability to meet obligations during disruption reflects preparation and leadership, qualities that resonate beyond the recovery period.

Institutionalizing Lessons Learned

Each disaster provides a real-world test of assumptions. Capturing insights requires deliberate review once immediate pressures subside.

Formal post-event assessments are important and must involve leadership, operations, finance, and risk advisors. Identifying what worked, where gaps emerged, and how decision-making unfolded informs future planning.

Integrating these lessons into policies, training, and capital allocation strengthens resilience over time. Organizations that institutionalize learning convert disruption into strategic improvement. Insurance plays a role not only in recovery but in shaping preparedness for future events.

A Disciplined Approach to Preparedness

Disasters introduce uncertainty, but outcomes are shaped by preparation. Insurance functions most effectively when aligned with operational realities and reviewed with intent. Protecting possessions is ultimately about safeguarding continuity, confidence, and long-term viability.

When insurance is treated as a strategic asset rather than a compliance requirement, it supports informed decision-making under pressure. It provides leaders with options when conditions are constrained and resources are strained. In the aftermath of disaster, that preparation enables organizations to recover with control and reopen with confidence.