Have you ever wondered why some investments make you sleep soundly at night while others keep you tossing and turning? The difference often comes down to understanding investment risk.

From buying your first stock to building a diversified portfolio as an experienced investor, understanding how to assess risk is essential to achieving financial success.

Risk isn’t just about losing money – it’s about understanding what you’re getting into and making informed decisions that align with your goals.

This blog shows you exactly how to determine investment risk using simple, practical methods that anyone can master.

What Is Investment Risk?

Investment risk is the possibility that your investment might lose value or not perform as expected. It’s the uncertainty that comes with investing your money in financial markets.

Think of it like weather forecasting. Just as meteorologists can’t guarantee perfect weather predictions, investors can’t eliminate uncertainty completely. But understanding risk helps you prepare for different scenarios.

Common types of investment risk include:

- Market risk – Overall market movements affecting your investments

- Credit risk – The chance that a company or government won’t be able to pay back debt

- Inflation risk – When rising prices reduce your purchasing power

- Liquidity risk – Difficulty selling an investment quickly

- Interest rate risk – How changing rates affect bond and stock prices

Key Factors That Affect Investment Risk

Every investment carries some level of risk, but not all risks are created equal. Understanding the key factors that influence investment risk can help you protect your money and grow it wisely.

1. Time Horizon

Your investment timeline hugely impacts risk levels. Here’s how time affects your risk profile:

Short-term investments (less than 2 years):

- Higher volatility risk

- Less time to recover from market downturns

- Better suited for conservative investments

Long-term investments (5+ years):

- More time to ride out market fluctuations

- Historical data shows higher potential returns

- Can handle more aggressive investments

2. Diversification Level

Spreading your investments across different asset classes reduces overall risk. A well-diversified portfolio might include:

| Asset Type | Risk Level | Typical Allocation |

|---|---|---|

| Stocks | High | 60-80% (young investors) |

| Bonds | Medium | 20-40% |

| Real Estate | Medium-High | 5-15% |

| Cash/CDs | Low | 5-10% |

By understanding what influences risk, you can build a portfolio that aligns with your goals and risk tolerance.

3. Your Risk Tolerance

Risk tolerance refers to your emotional and financial ability to withstand investment losses. Consider these questions:

- How would you feel if your investment dropped 20% in one month?

- Can you afford to lose this money without affecting your daily life?

- Do market fluctuations cause you stress or excitement?

How to Assess Different Types of Investments?

Different investments come with varying levels of risk and reward. Knowing how to evaluate each type helps you build a portfolio that matches your goals and comfort level.

Stocks

Individual stocks carry higher risk but offer greater growth potential. When evaluating stock risk:

Look at company fundamentals:

- Revenue growth trends

- Debt-to-equity ratios

- Market position and competition

- Management quality

Check market indicators:

- Beta coefficient (measures volatility compared to the market)

- Price-to-earnings ratio

- Trading volume and liquidity

Bonds

Bonds are generally considered lower risk than stocks, but they aren’t risk-free. Consider:

- Credit rating – Higher-rated bonds (AAA, AA) are safer

- Interest rate sensitivity – Longer-term bonds are more sensitive

- Issuer stability – Government bonds are typically safer than corporate bonds

Mutual Funds and ETFs

These pooled investments offer instant diversification but come with their own considerations:

- Expense ratios – Higher fees reduce returns

- Fund manager track record

- Underlying asset allocation

- Fund size and liquidity

Simple Risk Assessment Tools You Can Use

Managing investment risk is key to building a well-balanced portfolio that supports your long-term financial goals.

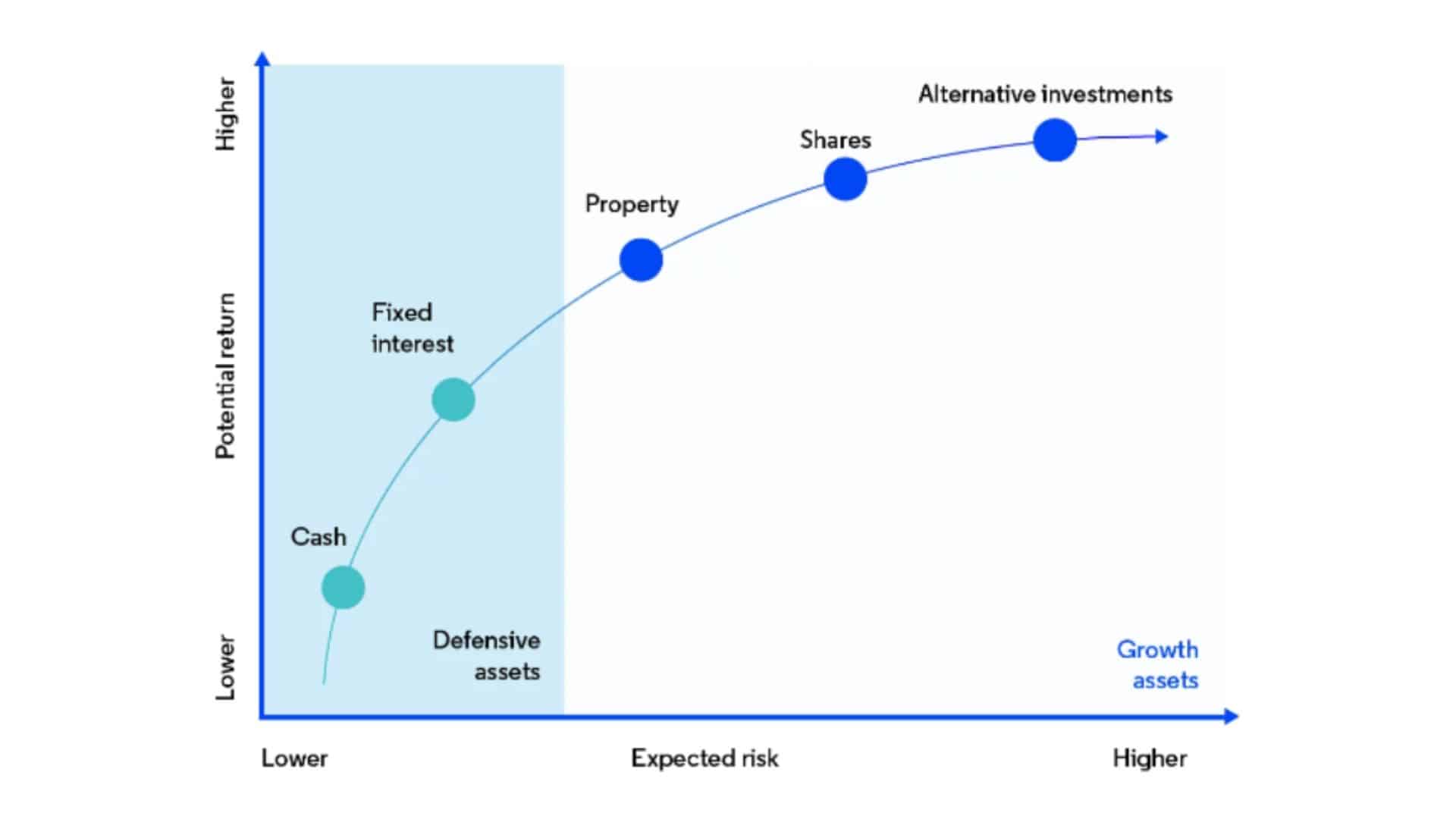

| Strategy | What It Means | Why It Matters |

|---|---|---|

| The 1% Rule | Limit each trade or position to 1–2% of your total portfolio value. | Helps protect your portfolio from large losses on any one asset. |

| Risk-Return Pyramid | Categorize investments as low, medium, or high risk. | Encourages diversification and risk control. |

| Standard Deviation | Measures the variation in returns from the average over time. | More variation means greater investment risk. |

Using these simple tools can help you manage your investment risk effectively and make more informed financial decisions.

Warning Signs of High Investment Risk to Avoid

Be cautious of investments that show these warning signs:

Unrealistic Promises

Be wary of offers that guarantee high returns with no risk or urge you to invest quickly in complex strategies you don’t fully understand.

Poor Fundamentals

Investments with declining revenues, high debt, unstable leadership, and limited transparency often carry higher risks.

Market Timing Risks

Trying to time the market by chasing bubbles, acting on hot tips, or panic selling during dips can lead to poor long-term outcomes.

Creating Your Personal Risk Profile

Your personal risk profile shapes how you approach investing and manage potential losses. Aligning your investments with your risk tolerance helps create a balanced and confident financial plan.

Step 1: Define Your Goals

Are you saving for retirement in 30 years or a house in 5 years? Different goals require different risk approaches.

Step 2: Assess Your Financial Situation

- Emergency fund status – Have 3-6 months’ expenses saved

- Income stability – Steady income allows for more risk

- Debt levels – Pay off high-interest debt first

Step 3: Determine Your Risk Capacity

This is different from risk tolerance. It’s about what you can mathematically afford to lose based on your financial situation.

Step 4: Regular Review and Adjustment

Your risk profile changes over time. Review annually or after major life events:

- Job changes

- Marriage or divorce

- Having children

- Approaching retirement

Conclusion

Learning how to determine investment risk isn’t about eliminating uncertainty – it’s about making informed decisions that align with your goals and comfort level.

Remember that all investments carry some level of risk, but understanding these risks helps you build a portfolio that suits your specific situation.

Begin by assessing your own risk tolerance and financial goals, and then utilize the tools and strategies we’ve discussed to evaluate potential investments.

The key is finding the right balance between growth potential and peace of mind.