A wrongful death settlement is a legal resolution that provides financial compensation to family members or dependents of a person whose death was caused by another party’s negligent, careless, or intentional act.

In the United States, wrongful death claims are governed by both state statutes and case law, ensuring that eligible survivors, typically spouses, children, or parents, can recover for the financial and emotional losses tied to their loved one’s passing.

For families, learning about average settlement values is crucial, as it helps set realistic expectations during one of life’s most devastating events.

Average Wrongful Death Settlement Ranges

When families face the tragic loss of a loved one due to another party’s negligence or intentional conduct, learning about potential compensation becomes important for both financial planning and closure.

The average wrongful death settlement in the United States typically ranges between $500,000 and $1 million, though this figure requires careful interpretation.

Recent data from a Thomson Reuters analysis of 956 wrongful death cases between 2019 and 2024 reveals important insights about actual settlement amounts:

- Median settlement: $294,728 (significantly below high-profile verdicts reported in media)

- Settlement confidentiality: Most agreements remain private under court orders

- Data limitations: Public access to comprehensive settlement information is restricted

The substantial difference between median and average settlement amounts reflects the statistical impact of exceptionally large awards in cases involving significant liability or high-earning decedents.

Wrongful death settlements depend on numerous specific circumstances surrounding the death. These variables create considerable variation in final settlement amounts across different cases.

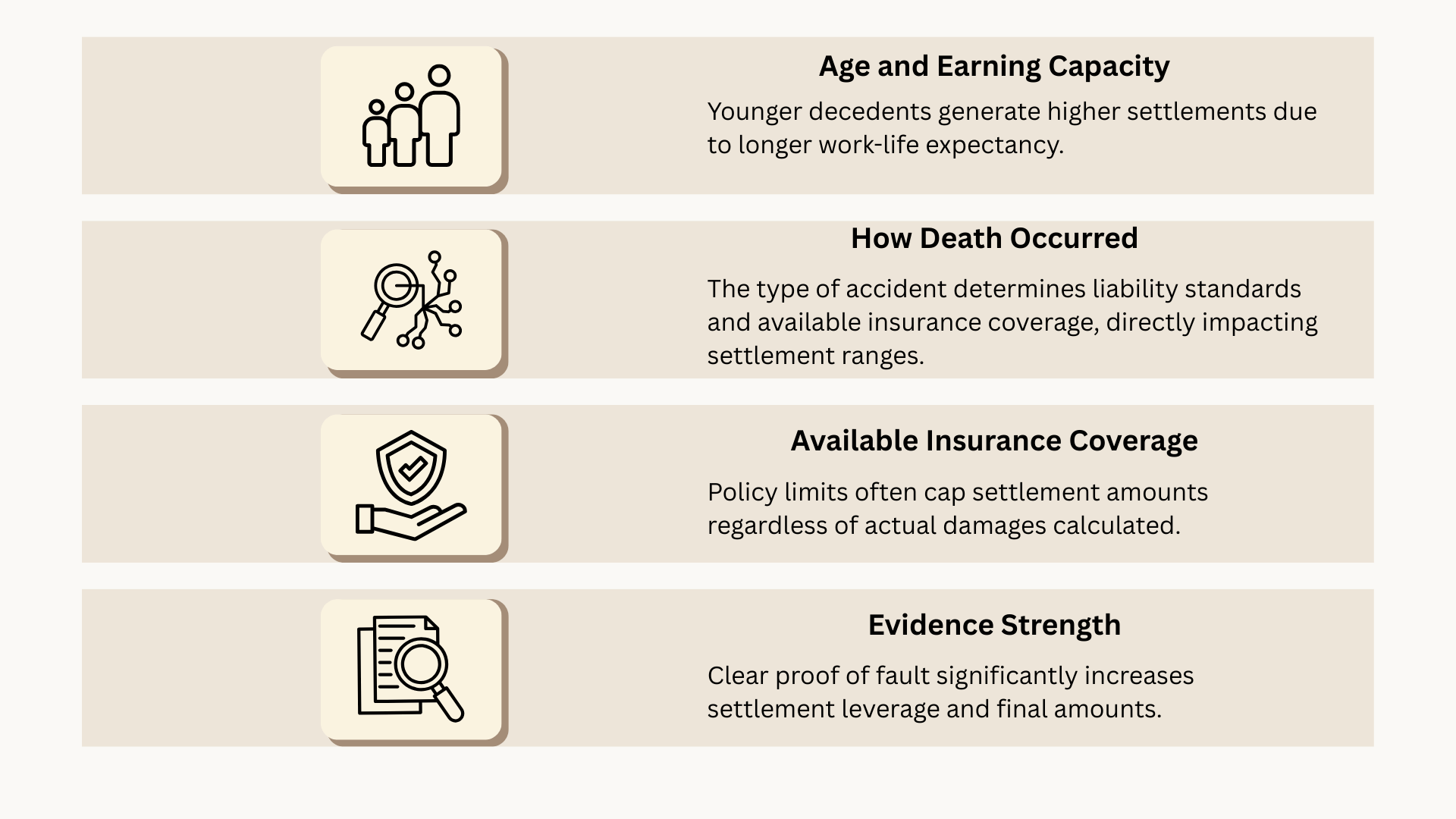

What Determines Your Settlement Amount?

Settlement amounts aren’t random numbers pulled from thin air. Four critical factors work together to determine the amount of compensation families ultimately receive.

These elements interact with each other, meaning a strong case in one area can sometimes offset weaknesses in another.

Courts and insurance companies evaluate these factors systematically when determining fair compensation.

Understanding how each element influences your potential settlement helps families approach negotiations with realistic expectations and better preparation.

These factors combine differently in every case. A young person’s death with clear evidence might still face low settlement limits due to minimal insurance.

Meanwhile, an older person’s case with weaker evidence could settle for more if better insurance coverage is available.

Understanding these four factors helps families set realistic expectations and work effectively with their legal team to achieve the best possible settlement outcomes.

Wrongful Death Compensation Types

Wrongful death settlement average amounts include several damage categories calculated using established legal methods.

1. Economic Damages

These represent measurable financial losses. Lost income is the most significant component – lawyers project lifetime earnings using employment records and tax returns.

For example, a 40-year-old earning $75,000 annually with 25 remaining work years would have gross lifetime earnings of $1,875,000, minus personal living expenses (typically 25-40%) and adjusted to present value.

Other economic damages include medical expenses before death, funeral costs, and the value of household services the deceased provided.

2. Non-Economic Damages

These address intangible losses requiring subjective assessment. Pain and suffering compensate for the distress the deceased experienced before death.

Loss of companionship covers the relationship value with surviving family members, including guidance and emotional support. Some states limit or exclude grief and emotional distress damages for survivors.

3. Punitive Damages

Awards for particularly reckless conduct, such as drunk driving deaths or corporate negligence. Many states cap these damages or have strict requirements for awarding them.

Punitive damages aim to punish the defendant and deter similar future conduct rather than compensate the family. These awards require proving that the defendant’s actions went beyond ordinary negligence to demonstrate willful misconduct or gross indifference to human life.

How State Laws Affect Settlement Amounts

Average wrongful death settlement amounts vary significantly across states due to different laws, damage caps, and legal procedures.

| State | Who Can File | Filing Deadline | Damage Standard | Punitive Damage Cap | Key Features |

|---|---|---|---|---|---|

| Kentucky | Court-appointed personal representative only | 1 year from the representative appointment | Economic + Non-economic damages | No statutory cap | Strict distribution order: spouse, then children, then parents |

| Georgia | Court-appointed personal representative | 2 years from the death date | “Full Value of Life” standard | $250,000 (exceptions for DUI/intentional acts) | Broader damage recovery than most states |

| North Carolina | Court-appointed personal representative only | 2 years from the death date | Statutory damage categories | 3x compensatory damages or $250,000 (whichever is larger) | Funds distributed outside the probate estate |

Settlement Ranges by Case Category

Different types of accidents typically produce different settlement ranges. These patterns help families know what might be reasonable for their situation.

- Motor Vehicle Deaths: $25,000 to $10 million (ranges from minimum insurance coverage to commercial vehicle cases with higher policy limits)

- Medical Malpractice: $200,000 to $10 million (misdiagnosis cases start lower, while birth injuries and surgical errors reach higher amounts, often limited by state caps)

- Workplace Fatalities: $300,000 to $3 million (construction accidents typically yield more than industrial cases, with third-party liability increasing settlements)

- Product Liability: $500,000 to $20 million (vehicle defects and medical device failures generate the highest settlements as companies avoid negative publicity)

Tax Implications of Wrongful Death Settlements

Most families don’t owe taxes on wrongful death settlement compensation, but important exceptions exist.

Federal law excludes compensatory damages for physical injury or death from income taxes, including medical expenses, lost income calculations, pain and suffering awards, and loss of companionship compensation.

However, some portions may create tax obligations: punitive damages are taxable as income, along with interest earned on settlement amounts and pre-judgment interest on awards.

Attorney fee deductions follow complex rules that vary by situation.

Large settlements warrant consultation with tax professionals since state tax rules may differ from federal law, and some families face unexpected tax bills without proper planning.

The Bottom Line

Wrongful death settlements provide accountability and stability when families need it most. While every case follows its own path, the factors and ranges outlined here offer a foundation for realistic expectations.

The legal landscape varies significantly by state, case type, and individual circumstances, making professional guidance essential.

No settlement can restore what was lost, but a proper legal resolution ensures families receive fair compensation while holding responsible parties accountable.

The process may seem overwhelming, but knowledge of these key elements helps families approach their situation with confidence.

Have questions about settlement factors we covered? Share your thoughts in the comments below to help other families facing similar situations.