Do you ever wonder what happens to the thousands of dollars you pay in local taxes each year?

Most Americans pay property tax, sales tax, and other local fees without really knowing where that money ends up. The truth might surprise you.

Local taxes fund everything from your child’s school to the fire truck that responds to emergencies.

They fix potholes, maintain parks, and keep libraries open. Yet many people have no idea how these systems work or why tax bills vary so much between towns.

In this blog, I’ll show you exactly what local taxes are, where your money goes, and why understanding these systems can help you make better decisions about your community and finances.

What Are Local Taxes and Why Do They Matter?

Local taxes are fees collected by cities, counties, school districts, and special districts to fund government services in your area. Unlike federal taxes that go to Washington, D.C., local taxes stay close to home.

The three main reasons local taxes matter:

- Direct impact: Your tax dollars fund services you use daily

- Local control: Communities decide how to spend the money

- Property values: Good services funded by taxes can increase home values

Local governments have limited options for raising money. They can’t print money like the federal government. Property taxes, sales taxes, and fees are their primary sources of income.

What Are the Main Types of Local Taxes

Local governments collect different types of taxes to fund schools, roads, safety, and other essential services. The main categories include:

1. Property Tax: The biggest local tax for most homeowners. Based on your home’s assessed value and local tax rates. Collected annually or through monthly mortgage payments.

2. Sales Tax: Added to purchases at stores and restaurants. State governments set base rates, but cities and counties can add their own portions. Rates range from 0% to over 10% across the nation.

3. Local Income Tax: Some cities and counties impose an additional income tax on top of state taxes. More common in states like Ohio, Pennsylvania, and Kentucky.

4. Special Fees and Assessments: Charges for specific services, such as garbage collection, street lighting, or stormwater management. Usually appear as separate line items on tax bills.

Together, these taxes ensure communities have the resources to provide public services, though the mix and amounts vary widely depending on where you live.

Where Does Your Tax Money Really Go?

Local taxes fund the essential services you rely on every day. While percentages vary by community, most budgets are divided into these main areas:

| Service Area | Percentage of Budget | Examples |

|---|---|---|

| Education | 35 to 50% | Schools, teachers, buses, textbooks |

| Public Safety | 15 to 25% | Police, fire, emergency services |

| Transportation | 10 to 20% | Road repair, traffic signals, snow removal |

| Health & Social Services | 8 to 15% | Public health, senior services, mental health |

| Parks & Recreation | 3 to 8% | Parks, pools, community centers |

| General Government | 5 to 10% | City hall, elections, administration |

The exact percentages vary by location. Rural areas might spend more on roads. Urban areas often have higher public safety costs.

How Much of Property Tax Goes to Schools?

In most areas, between 40% and 60% of property taxes are allocated directly to school districts. This makes property tax the primary source of funding for public education.

School districts issue their own tax bills separate from city and county taxes. Your total property tax bill usually includes:

- School district tax (largest portion)

- County tax

- City or township tax

- Special district taxes (library, fire, etc.)

States with higher property taxes often have better-funded schools. But this creates inequality between wealthy and poor districts.

How Local Sales Tax Is Allocated in Your County

When you buy something at a store or restaurant, the sales tax you pay doesn’t all go to the same place. Instead, it’s split among different levels of government and sometimes even special-purpose districts.

The exact breakdown varies depending on state law, but here’s how it usually works:

-

State portion – A share of your purchase goes to the state government, helping fund statewide programs such as education, transportation, or healthcare initiatives.

-

County portion – Counties receive a cut to support services like courts, jails, sheriff’s departments, and local health programs.

-

City portion – The city where you shop often collects a portion of the tax to pay for municipal services, such as road maintenance, police, fire protection, and libraries.

-

Special districts – Some areas impose additional sales taxes dedicated to specific projects, such as regional transit systems, sports stadiums, or local economic development efforts.

It’s also worth noting that online purchases often do not include local sales tax, which can significantly reduce funding for community services. As more shopping shifts online, many cities and counties are seeking ways to bridge that gap.

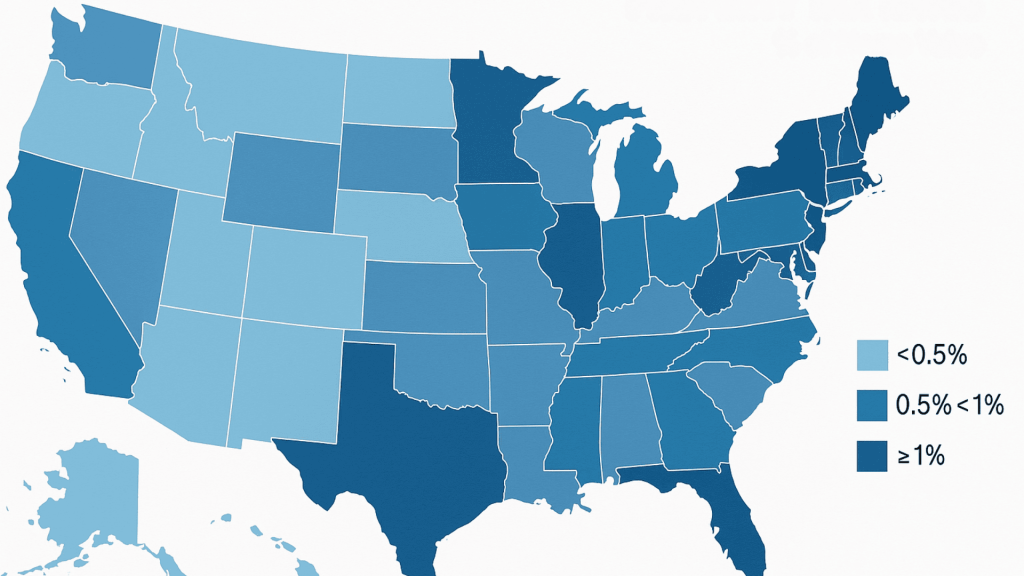

Comparing Local Tax Rates Across States

Local tax rates aren’t the same everywhere; some states pay much more in property and sales taxes than others. Here’s how they compare at a glance:

| Category | Highest | Lowest |

|---|---|---|

|

Property Tax (Avg. % of Home Value) |

New Jersey – 2.4% Illinois – 2.3% New Hampshire – 2.2% |

Hawaii – 0.3% Alabama – 0.4% Louisiana – 0.5% |

|

Sales Tax (Combined Rates) |

Louisiana – 10.02% Tennessee – 9.55% Arkansas – 9.44% |

Alaska – 0% Delaware – 0% Montana – 0% New Hampshire – 0% Oregon – 0% |

High-tax states often provide more local services. Low-tax states may rely more heavily on state funding or offer fewer services.

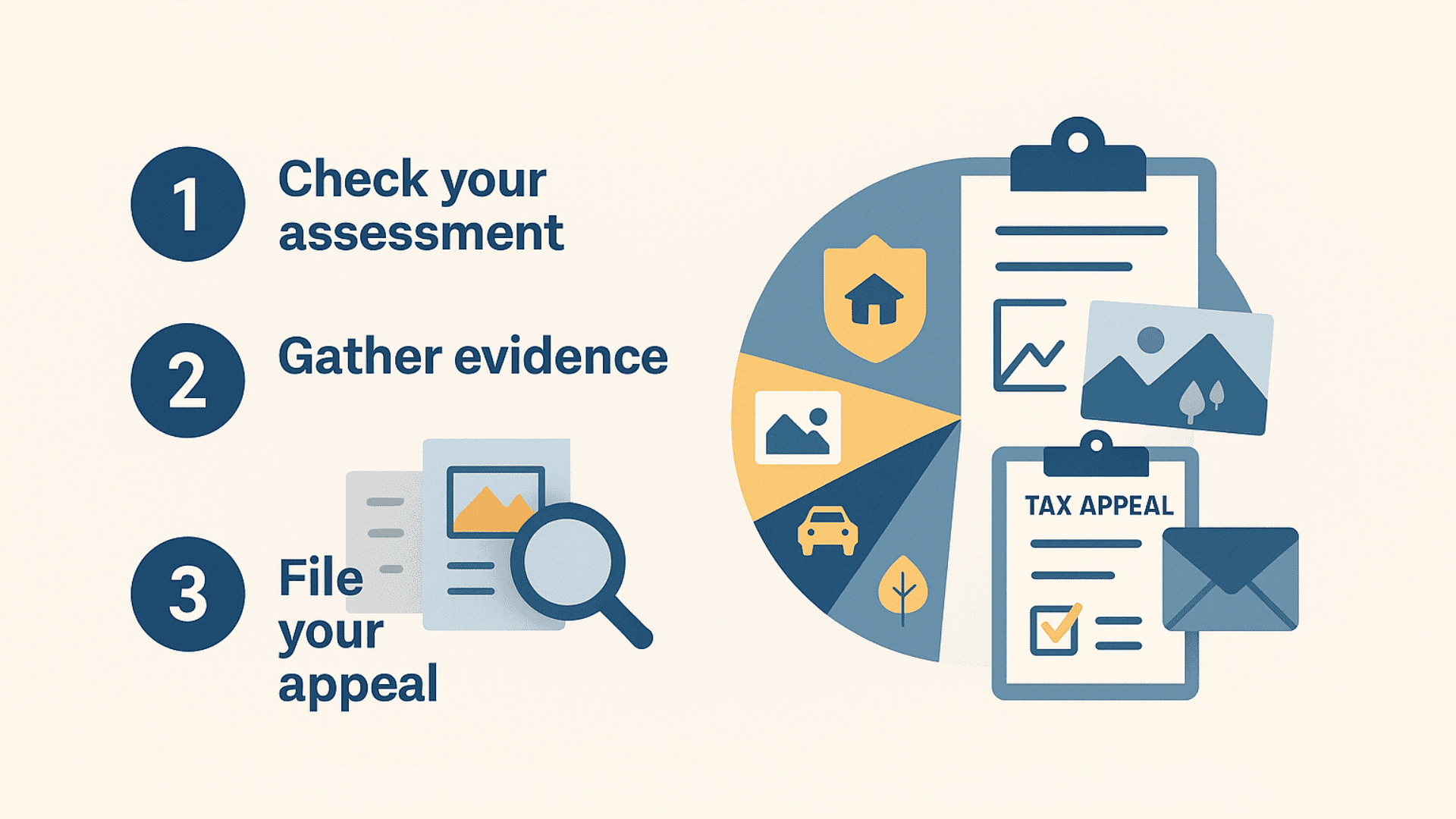

How to Appeal a Property Tax Bill

Think your property tax seems too high? Many homeowners face inflated assessments, but the good news is you can challenge them through a simple appeal process.

Step 1: Check your assessment

Start by reviewing your property’s assessed value and comparing it to recent sales of similar homes in your neighborhood. Pay close attention to details such as square footage, number of rooms, and property features.

Errors in these records are common, and even small inaccuracies can inflate your tax bill.

Step 2: Gather evidence

If you notice discrepancies, collect proof to support your claim. This might include recent sales data for comparable homes, as well as photos that highlight any issues with your property’s condition if you believe the assessment is significantly off.

The stronger your evidence, the better your chances of success.

Step 3: File your appeal

Once your case is ready, contact your local assessor’s office to begin the appeal process. Be mindful of deadlines most areas require appeals to be filed within 30 to 60 days of receiving the assessment notice.

You’ll typically need to submit forms and present your evidence at a hearing, where officials will review your claim and make a decision.

Success rates for property tax appeals range from 30% to 60%. While not guaranteed, a successful appeal can result in significant savings.

Why Understanding Local Taxes Strengthens Communities

Local taxes aren’t just numbers on a bill, they shape the services, schools, and overall quality of life in your neighborhood. Understanding where that money goes empowers you to make smarter choices in different roles:

-

As a voter: Support candidates whose priorities match how you want public funds spent.

-

As a homeowner: Weigh tax rates against the services you value most, like strong public safety or well-funded schools.

-

As a citizen: Know when to attend budget hearings and voice concerns about spending.

-

As a taxpayer: Hold officials accountable for how efficiently they manage public dollars.

The more residents understand taxes, the stronger their communities become. Informed citizens make choices that reflect shared values and ensure tax money is used wisely.

Conclusion

Local taxes fund the services that make communities work. Your property tax pays for schools and police. Sales tax funds road repairs and maintain parks.

Understanding where this money goes helps you make better choices about where to live and how to vote.

The next time you get a tax bill, remember that money stays in your community. It teaches children, keeps you safe, and maintains the infrastructure you rely on every day.

Ready to learn more about your local taxes? Start by visiting your city or county website to see exactly how your tax dollars are being spent.