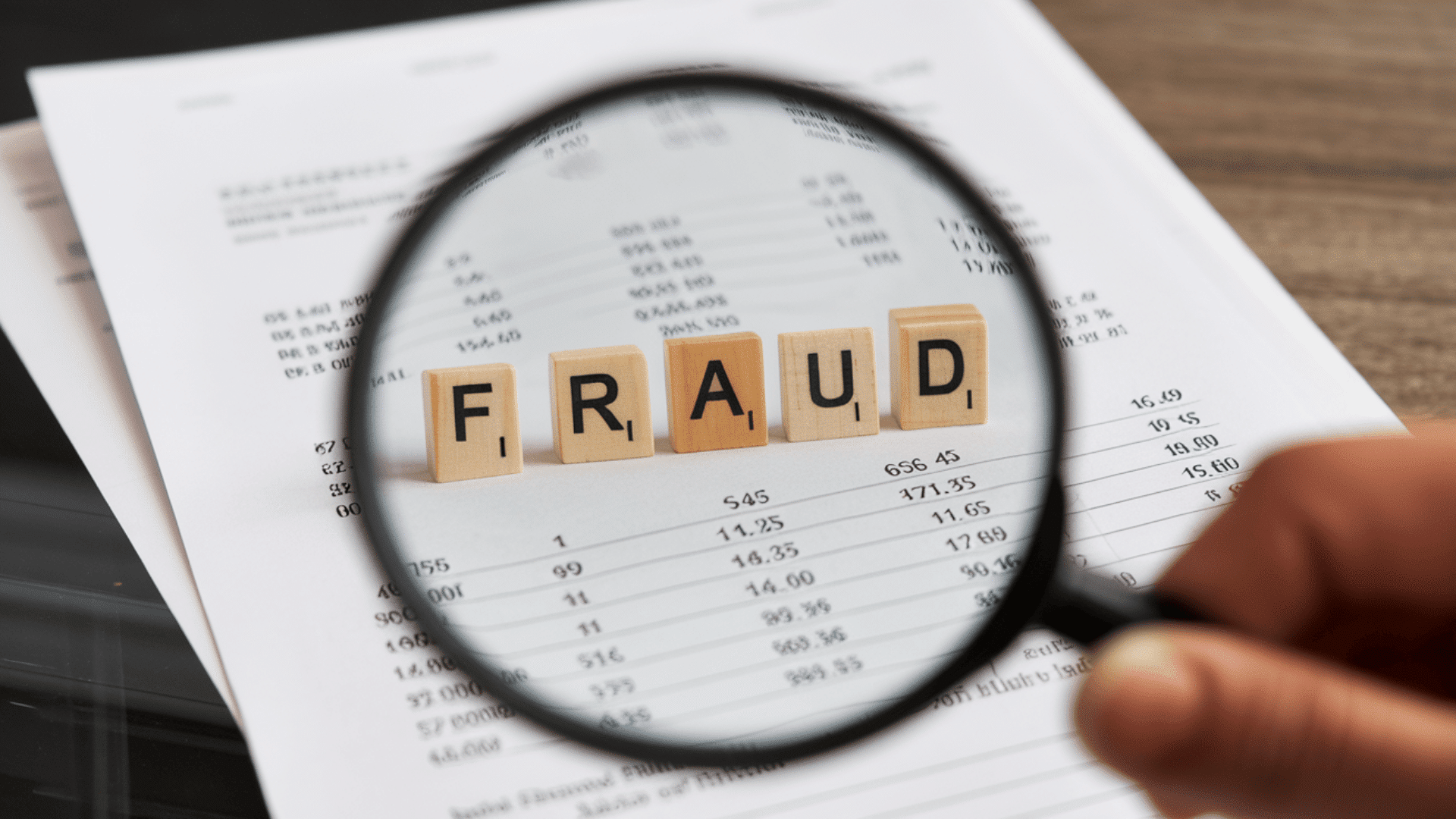

Have you ever wondered how investigators find hidden fraud before it causes major damage? Financial crimes cost businesses billions each year.

Many could be stopped early with the right steps. Legal investigators use proven methods to spot fraud fast. They follow clear steps that work in court.

In this blog, I’ll show you the exact financial fraud detection steps that legal professionals use. You’ll learn what to look for and how to protect your interests.

Why Fraud Detection Matters in Legal Investigations?

Financial fraud can destroy companies and ruin lives. Early detection saves money and protects reputations. Legal teams need solid proof that holds up in court.

When fraud goes unnoticed, the damage grows. Small issues become major crimes. Evidence gets harder to find over time. That’s why quick action matters.

Legal investigations require careful documentation. Every step must follow proper procedures. This protects the case and ensures justice.

Proper fraud detection also prevents future crimes. It sends a clear message to would-be offenders.

Victims often face both financial and emotional trauma. Insurance claims, legal fees, and business disruptions add up quickly.

Regulatory penalties can follow if companies fail to report fraud properly.

Core Financial Fraud Detection Steps

Every fraud investigation follows a clear process. These steps ensure nothing gets missed and evidence stays valid. Legal teams rely on this structured approach to build strong cases.

Below are the six primary steps that investigators use for financial fraud detection.

Tools and Techniques That Support Fraud Detection

Before proceeding through the given steps in detail, it is essential to understand that investigators utilize various tools to effectively detect financial fraud. Each tool serves a specific purpose and works best in certain situations.

Here’s a breakdown of the most common tools and when to use them:

| Tool/Technique | Purpose | When to Use |

|---|---|---|

| Forensic Accounting Software | Analyzes large data sets for anomalies | Complex financial records |

| Bank Record Analysis | Tracks money flow and unusual transactions | Suspected embezzlement |

| Digital Forensics | Recovers deleted files and emails | Computer-based fraud |

| Audit Trail Review | Follows transaction history | Internal fraud cases |

| Data Mining | Identifies hidden patterns | Large-scale investigations |

| Benford’s Law Analysis | Detects manipulated numbers | Financial statement fraud |

Pro Tip: Combining multiple tools increases detection accuracy. Don’t rely on just one method.

Step 1: Initial Assessment and Risk Analysis

Start by reviewing the situation. What triggered the concern? Review financial reports, complaints, or any unusual patterns.

Investigators gather basic information first. They identify who’s involved and what accounts matter. This creates a roadmap for the investigation.

Risk analysis helps prioritize efforts. High-risk areas get attention first. This saves time and resources.

Step 2: Data Collection and Document Review

Collect all relevant financial records. This includes bank statements, invoices, receipts, and contracts. Digital records matter too.

Organize documents by date and category. This makes patterns easier to spot. Missing records can be red flags themselves.

Review emails and communication logs. These often reveal intent. They show who knew what and when.

Step 3: Financial Analysis and Pattern Recognition

Compare actual transactions against expected behavior. Look for unusual amounts, frequencies, or timing.

Use ratio analysis and trend comparison. These methods spot outliers quickly. They reveal inconsistencies in financial data.

Check for duplicate payments or fake vendors. These are common fraud schemes. Cross-reference all data sources for accuracy.

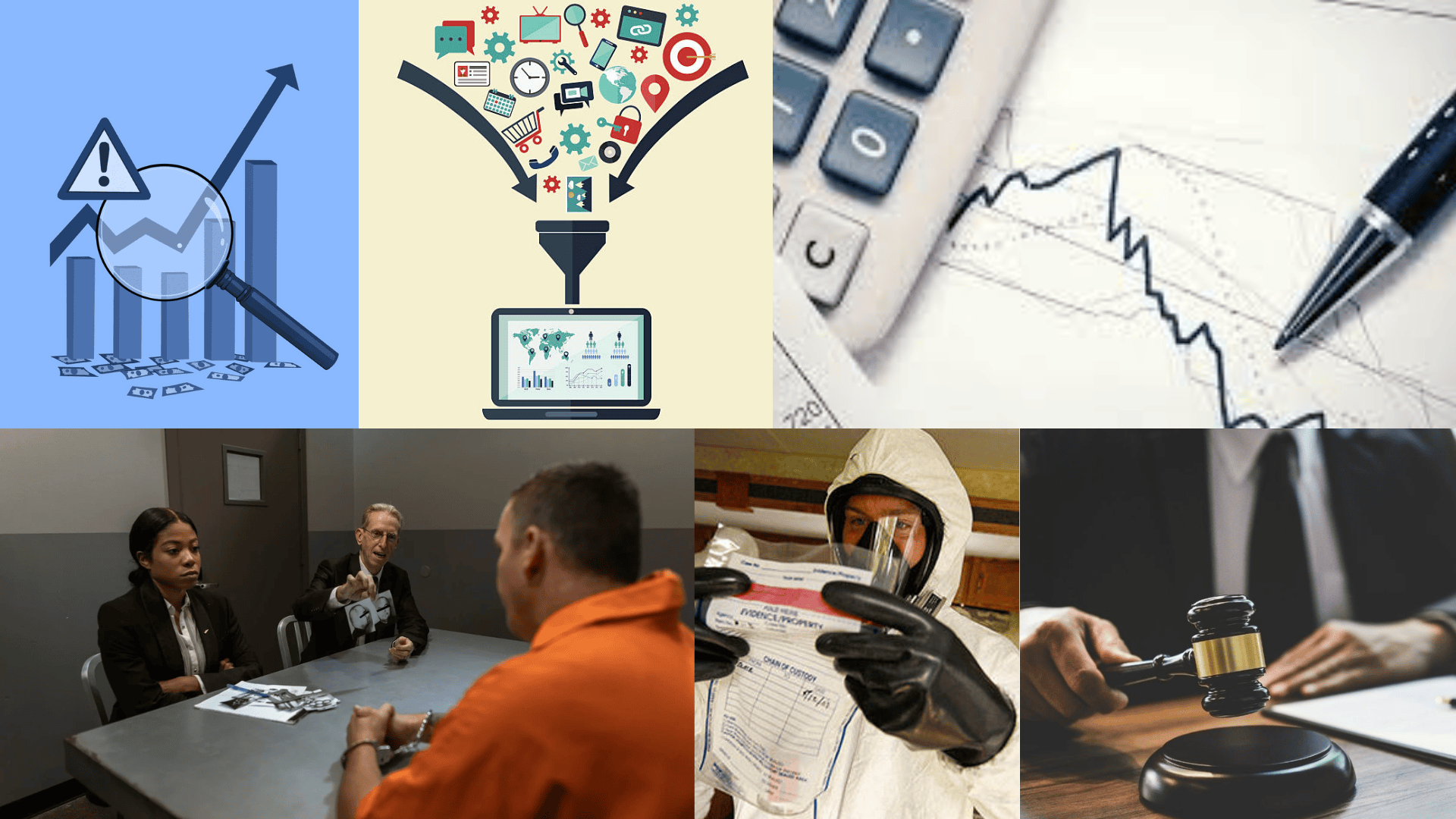

Step 4: Interview Key Witnesses and Suspects

Talk to people who have information. This includes employees, vendors, and clients. Their statements provide context.

Record all interviews properly. Take detailed notes or use recordings with consent. This protects the investigation’s integrity.

Watch for inconsistent stories. People involved in fraud often change details. Body language and hesitation can signal problems.

Step 5: Evidence Preservation and Chain of Custody

Secure all evidence immediately. Make copies of original documents. Store them in controlled environments.

Maintain a clear chain of custody. Document who handled the evidence and when. This ensures admissibility in court.

Use forensic tools for digital evidence. These preserve metadata and timestamps. They prove evidence hasn’t been altered.

Step 6: Report Compilation and Legal Action

Compile findings into a clear report. Include timelines, evidence, and conclusions. Make it easy to understand.

Work with legal counsel to determine next steps. This might include civil suits or criminal charges. The evidence guides the decision.

Prepare for testimony if needed. Investigators often explain their methods in court. Clear documentation makes this easier.

Warning Signs Investigators Look For

Experienced investigators know what to look for. Certain signs appear repeatedly in fraud cases. Spotting them early can save months of investigation time.

- Unusual transaction patterns: Payments just below reporting thresholds or frequent round-number amounts

- Missing documentation: Gaps in records or incomplete files that can’t be explained

- Lifestyle inconsistencies: Employees living beyond their means without clear income sources

- Vendor irregularities: Fake companies, missing contact information, or no physical addresses

- Duplicate payments: Same invoice paid multiple times to different accounts

- Reluctance to share information: Employees who resist providing standard documentation

Key Consideration: One red flag alone may not prove fraud. Look for multiple indicators that form a pattern.

Legal Challenges and Documentation in Fraud Investigations

Legal fraud investigations face unique obstacles. Evidence must meet strict standards. Any mistakes can ruin a case.

- Privacy laws protect certain information. Investigators must know what they can access legally. Warrants or subpoenas may be needed.

- Time sensitivity creates pressure. Evidence can disappear quickly. Statute of limitations also apply to fraud cases.

- Documentation requirements are strict. Every action needs proper records. Courts reject evidence that was improperly obtained.

- Work with experienced legal counsel. They guide investigators through complex rules. This protects both the case and the organization.

- Expert testimony often helps explain technical details. Forensic accountants can break down complex schemes. Their credentials add credibility in court.

Conclusion

Financial fraud detection steps protect organizations and individuals from serious harm. Effective detection requires a systematic approach that catches problems early.

Start with assessment, collect data thoroughly, and analyze patterns carefully. Interview witnesses, preserve evidence, and document everything properly. These steps work in legal investigations because they follow proven methods that stand up in court.

Early detection stops fraud before it grows into bigger problems. It also ensures cases hold up when they reach the legal system. Proper documentation and evidence collection make the difference between winning and losing fraud cases.

What fraud detection method do you think works best in legal investigations? Share your thoughts below.