Have you ever wondered what would happen if you got sick in a foreign country or had to cancel your dream vacation at the last minute?

Travel insurance might seem like an unnecessary expense, but it can be the difference between a minor inconvenience and a financial disaster.

Whether you’re planning a weekend getaway or a month-long international adventure, understanding your coverage options is crucial.

Whether you’re planning a weekend getaway or a month-long international adventure, understanding your coverage options is crucial for protecting both your health and your wallet.

What Does Travel Insurance Cover?

Travel insurance isn’t just one thing – it’s actually a bundle of different protections designed to cover various travel mishaps. Here are the main coverage areas:

Medical Coverage

This is the foundation of any good travel insurance policy. Medical coverage protects you when health emergencies strike far from home.

It covers emergency medical treatment, dental care, prescription medications, and mental health support abroad. Most importantly, it includes medical evacuation to your home country when local facilities can’t provide adequate care.

Trip Protection

Your vacation investment deserves protection, too. Trip protection coverage safeguards the money you’ve already spent on your travels.

This covers trip cancellation for illness, death, or other covered reasons, trip interruption if you need to return home early, plus compensation for trip delays and missed connections, including meals, accommodations, and additional expenses.

Personal Protection

Beyond health and trip costs, travel insurance protects your belongings and provides essential support services.

Coverage includes baggage protection (for lost, stolen, or damaged items), liability coverage (in the event of accidental harm), identity theft assistance, and round-the-clock emergency support.

Travel Medical Insurance vs Trip Insurance

Many travelers get confused about these two types of coverage, but they serve different purposes. Here’s a clear comparison:

| Feature | Travel Medical Insurance | Trip Insurance |

|---|---|---|

| Primary Focus | Protects your health abroad | Protects your financial investment |

| Medical Care & Evacuation | Full coverage up to $1M+ | Not included |

| Trip Cancellation | Not covered | Reimburses prepaid costs |

| Baggage & Delays | Not included | Full coverage |

| Best For | International travel, adventure trips | Expensive trips, non-refundable bookings |

| Average Cost | $30-$80 per trip | $100-$300 per trip |

Best Travel Insurance for International Trips

When traveling internationally, your coverage needs are different from those of domestic trips. Here’s what to prioritize:

Critical Coverage Minimums Medical evacuation coverage starts at $1 million, emergency medical coverage requires at least $100,000, and repatriation of remains needs $50,000 minimum.

These amounts protect against the highest costs of international medical emergencies.

Must-Have Policy Features

- 24/7 multilingual assistance

- Coverage in all countries you’re visiting

- No restrictions on the adventure activities you plan to do

- Direct billing arrangements with international hospitals

- Prescription medication coverage

- Emergency cash advance services

With the right international coverage, you can explore the world knowing you’re protected against life’s unexpected moments.

Pre-Existing Condition Coverage Explained

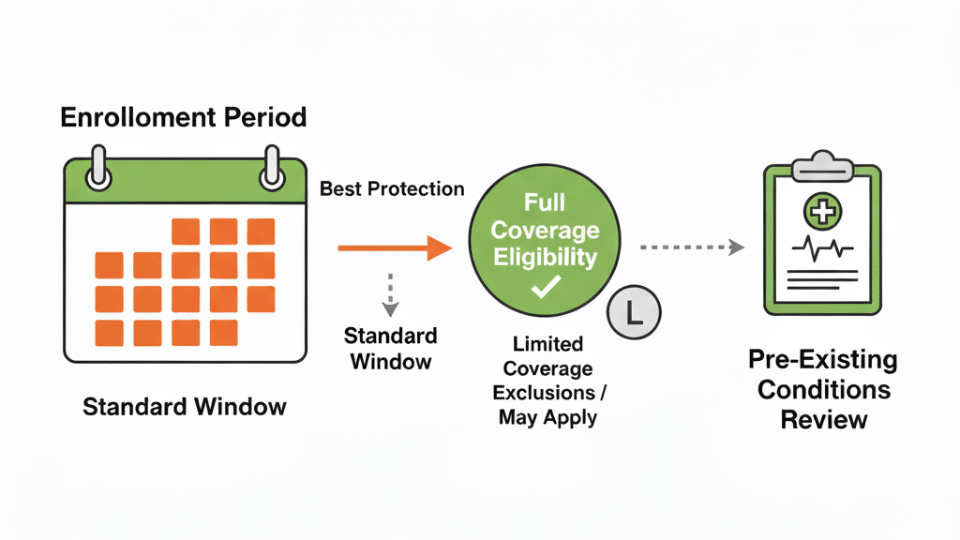

Navigating travel insurance with pre-existing conditions requires understanding specific timing and requirements. This breakdown shows you everything:

Pre-existing medical conditions don’t automatically disqualify you from travel insurance, but they require special handling.

These include any recent medical treatments, regular medications, or conditions your doctor has advised you about.

To get coverage, purchase insurance within 10-21 days of your first trip payment, choose a policy that includes pre-existing condition coverage, meet stability period requirements (usually 60-180 days of stable health), and always disclose conditions honestly since hiding them voids your policy.

Travel Insurance for Different Age Groups

A 20-year-old backpacker and a 70-year-old retiree face completely different travel risks and insurance requirements.

For Seniors (65+)

Older travelers should prioritize higher medical coverage limits, coverage for common conditions like heart disease or diabetes, prescription medication coverage abroad, and enhanced emergency evacuation limits.

To save money, look for senior-specific policies, consider annual coverage if you travel frequently, check your Medicare supplement for travel benefits, and compare policies designed for mature travelers.

For Students

Students should focus on basic medical coverage, study abroad program protection, coverage for expensive electronics, and adventure activity insurance.

Budget-friendly options include student discounts from major insurers, medical-only coverage for low-cost trips, group policies for schools, and credit card travel benefits.

How to Choose the Right Travel Insurance Policy

Finding the right travel insurance is easier than you think when you follow a systematic approach:

Step 1: Evaluate Your Travel Risk Profile

Assess your destination’s healthcare quality and political stability, evaluate your current health status and any pre-existing conditions, and calculate your total trip investment, including flights and accommodations.

Review planned activities for adventure or high-risk elements, and consider your age and travel experience level.

Step 2: Determine Your Coverage Priorities

Identify which risks concern you most – medical emergencies, trip cancellation, or baggage loss.

Consider your existing coverage through health insurance, credit cards, or employer benefits. Factor in your financial ability to absorb unexpected costs without insurance protection.

Step 3: Compare Coverage Levels and Types

Choose between Basic (emergency medical and evacuation only), Standard (medical plus comprehensive trip protection), or Comprehensive (full coverage including baggage, delays, and enhanced benefits).

Consider annual policies if you travel frequently, or single-trip coverage for occasional travelers.

Step 4: Research Providers and Policy Details

Read policy exclusions carefully to understand what’s not covered and verify coverage limits meet your destination’s requirements.

Compare deductibles and claim procedures across providers, and check customer reviews and financial strength ratings from independent agencies like A.M. Best.

Step 5: Purchase at the Right Time

Buy within 10-21 days of your first trip payment to maximize benefits like pre-existing condition coverage, and purchase before any travel advisories or known events affect your destination. Ensure you have adequate time to review policy documents before departure.

A little research upfront can save you thousands of dollars and endless headaches later.

Common Mistakes to Avoid and Filing Claims

Don’t let these common errors leave you unprotected. Many travelers make critical mistakes that void their coverage when they need it most.

The biggest mistakes include waiting too long to buy coverage, buying inadequate medical coverage for international travel, not reading policy exclusions, assuming regular insurance covers travel (most don’t), and failing to declare pre-existing conditions honestly.

If you need to file a claim, act quickly and document everything. The process is straightforward when you follow the right steps.

Essential Claims Actions:

- Contact your insurance company’s 24/7 hotline immediately

- Keep all receipts and take photos of damaged items

- Obtain official reports (police, medical, incident reports)

- Gather original receipts, medical records, and proof of cancellation reasons

- Submit thorough documentation – it makes or breaks your claim

Conclusion

Travel insurance is one of those things you hope you’ll never need, but you’ll be incredibly grateful to have if something goes wrong.

From protecting your health abroad to safeguarding your vacation investment, the right policy gives you freedom to explore with confidence.

Remember, the best travel insurance policy is the one that matches your specific needs, destination, and budget.

Don’t let the variety of options overwhelm you. Start with the basics and build up coverage as needed.

Ready to protect your next adventure? What questions do you have about choosing the right travel insurance for your upcoming trip? Share your travel insurance experiences or concerns in the comments below!