Elder financial abuse is hitting California seniors hard, stripping away life savings, dignity, and independence. Families watch helplessly as trusted caregivers, relatives, or strangers steal from vulnerable adults through scams, forgery, or manipulation.

California leads the nation with strong laws protecting elders from financial exploitation. This guide explains how these laws work, warning signs to watch for, reporting procedures, and available resources. You’ll learn your rights and find practical steps to protect your loved ones.

By the end, you’ll know exactly how to respond when elder financial abuse strikes your family.

What Is Elder Financial Abuse?

Elder financial abuse happens when someone misuses or takes an older adult’s money, property, or assets without permission.

In California, the law defines an elder as anyone 65 years of age or older.

This type of abuse can destroy families and leave seniors without the resources they need for basic care. The financial damage often goes beyond money – victims lose trust in others and feel helpless about their future.

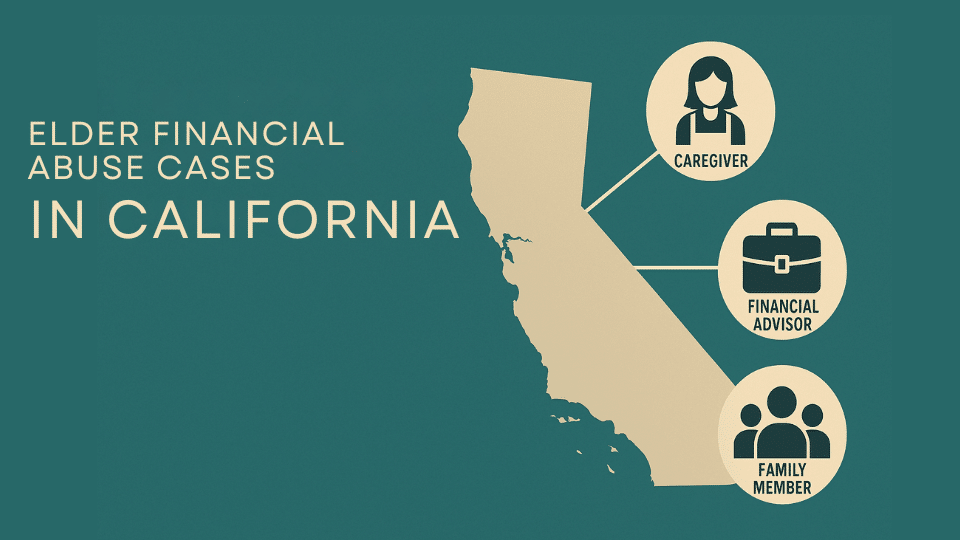

The abuse can be obvious, like forging checks, or subtle, such as using guilt or pressure to change a will. What makes this crime particularly harmful is that it often involves people whom the elderly trusts most. Common perpetrators include:

- Caregivers and relatives who have daily access to finances

- Financial advisors or trustees who manage investments and accounts

- Strangers running scams targeting seniors through lottery, romance, or telemarketing schemes

Examples of Elder Financial Abuse

Many seniors don’t report abuse because they feel embarrassed or fear losing their independence.

Others may not even realize they’re being taken advantage of, especially if they have memory issues or depend on the abuser for care. Look at some scenarios of how elder financial abuse can happen:

- Forging checks or using credit cards without permission.

- Convincing an elder to change a will, trust, or property deed under pressure.

- Pushing fake investment opportunities that promise high returns.

- Taking advantage of confusion or memory problems to gain control of funds.

- Stealing cash, jewelry, or valuable items from the home.

- Overcharging for services or charging for work never completed.

California Elder Financial Abuse Law

California takes elder financial abuse seriously and has created strong legal protections.

The state’s Welfare and Institutions Code §15610.30 defines financial abuse as taking, hiding, keeping, or retaining an elder’s property for wrongful use, or using undue influence to gain control.

This law covers both direct theft and more complex schemes that manipulate seniors into giving up their assets.

Two Main Types of Elder Financial Abuse

California law recognizes two main ways elder financial abuse happens:

- Wrongful use doesn’t require proof of intent; careless disregard of an elder’s rights can qualify. This means even family members who think they’re “helping” can face legal consequences if they misuse funds.

- Undue influence means manipulating, pressuring, or taking advantage of an elder’s mental or emotional state. This includes using fear tactics, isolation, or exploiting cognitive decline to control financial decisions.

What is Penal Code §368 (d & E)?

In addition to civil protections, California Penal Code §368 makes elder financial abuse a crime with serious consequences:

- PC 368(d): Covers abuse by non-caretakers (such as strangers, scammers, or distant relatives)

- PC 368(e): Addresses abuse by caretakers (including family members, hired caregivers, or anyone responsible for the elder’s care)

The law treats caretaker abuse more seriously because these individuals hold positions of trust and responsibility.

Penalties may include fines, repayment of stolen funds, and jail time. Courts impose harsher sentences if the victim suffers major financial loss, especially if the abuse causes significant harm to the elder’s quality of life or ability to pay for necessary care.

Civil vs. Criminal Remedies

Victims of elder financial abuse in California can pursue both civil and criminal justice.

| TYPE OF REMEDY | REMEDY PATH |

| Civil Lawsuits |

|

| Criminal Penalties |

|

Statute of Limitations

Victims generally have four years from the date of finding out to file a civil claim for elder financial abuse in California. Missing this deadline can prevent recovery, so quick action is important.

Alert Signs of Elder Financial Abuse

Elder financial abuse often shows up through sudden and unusual changes. Warning signs include:

- Unexplained withdrawals or transfers

- New “friends” or caregivers controlling bank accounts or legal papers

- Unpaid bills despite having enough funds

- Sudden changes to wills, deeds, or powers of attorney

- Emotional shifts: anxiety, fear, or confusion when money is discussed

How to Report Elder Financial Abuse in California?

If you suspect abuse, act right away. California provides multiple reporting options:

- Adult Protective Services (APS): Available in every county. Call 1-833-401-0832 (statewide APS hotline)

- Law Enforcement: File a police report if you suspect theft or fraud

- Financial Institutions: Banks and credit unions are legally required to report suspicious activity

- Attorney General’s Office (DOJ): Handles consumer fraud and elder abuse units. Visit oag.ca.gov or call (800) 952-5225

- Elder Law Attorneys: Can help with restraining orders, lawsuits, and guardianship requests

Government & Support Resources

Families don’t need to face elder financial abuse alone. Key resources include:

- Adult Protective Services (APS):APS Directory

- California Department of Aging:aging.ca.gov

- California Attorney General’s Office:oag.ca.gov

- California Courts Self-Help Center:courts.ca.gov/selfhelp

- National Center on Elder Abuse (NCEA):ncea.acl.gov

What are the Legal Rights of Victims?

California gives elder financial abuse victims strong legal protections:

- The right to file civil lawsuits for damages

- The right to seek protective orders restricting an abuser’s access

- The right to recover attorney’s fees to reduce barriers to justice

- The right to criminal prosecution if the abuser is convicted

| Duties of Financial Institutions

Under state law, banks and credit unions are on the front line of protection. Employees must report suspicious withdrawals, unusual activity, or suspected abuse. Failure to report can result in penalties for the institution. |

Some Famous Elder Financial Abuse Cases in California

Real cases highlight how courts apply the law:

1. Los Angeles Caregiver Case: A caregiver who took thousands from an elderly woman’s account faced criminal theft charges and was ordered to repay funds

2. Northern California Investment Scam: A financial advisor pushed seniors into fake schemes. Prosecutors charged him under securities fraud laws, while victims won civil judgments

3. San Diego Probate Dispute: Siblings accused a brother of undue influence over their mother. The court looked at medical records and testimony before ruling on the validity of the will

Conclusion

Elder financial abuse does more than drain bank accounts. It robs seniors of security, independence, and trust in others.

With California’s rapidly growing senior population, awareness is critical for protection.

Families who know the warning signs, understand the laws, and know available resources are better prepared to act quickly. By reporting abuse promptly and using legal tools, you can recover losses and safeguard your loved one’s dignity.

California law stands firmly on the side of seniors, offering strong protections through both civil and criminal remedies.

Have you noticed suspicious financial activity involving an elderly family member? Don’t wait, contact Adult Protective Services today.

Frequently Asked Questions

Can victims sue for elder financial abuse?

Yes. Victims can file civil lawsuits to recover losses, attorney’s fees, and, in some cases, punitive damages.

What is the statute of limitations for elder financial abuse claims?

Generally, victims have four years from finding out about the abuse to file a civil lawsuit.

Who Investigates Elder Financial Abuse in California?

Investigations may involve Adult Protective Services, local law enforcement, financial institutions, and the Attorney General’s Office.