Understanding your net worth is the cornerstone of financial health and wealth building.

Starting your financial journey or planning for retirement, knowing how to calculate your net worth accurately provides a clear snapshot of your current financial position and helps guide your future financial decisions.

This comprehensive guide will help you to calculate your net worth accurately, avoid common mistakes, and build a solid foundation for long-term financial security and wealth creation.

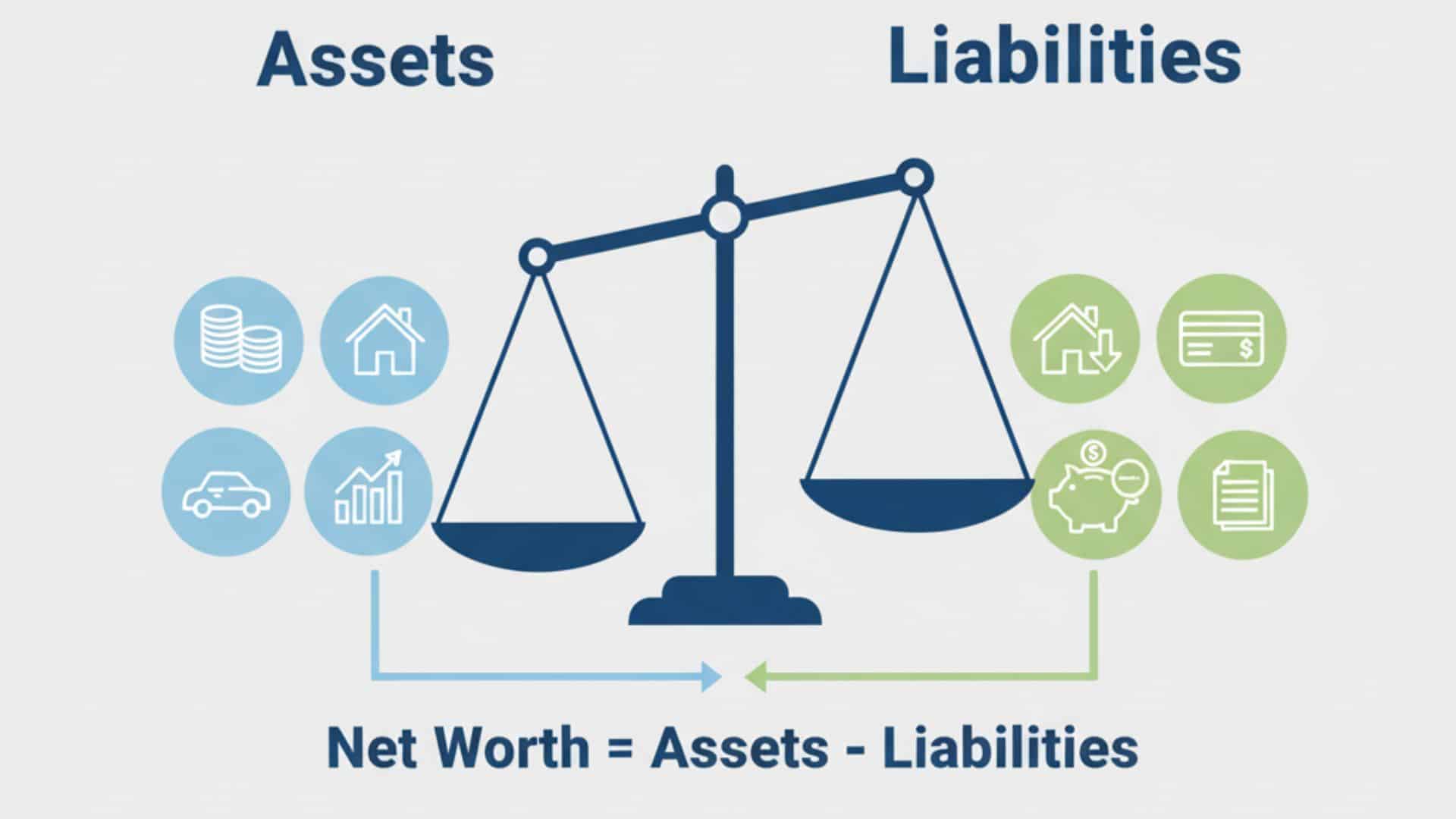

What Is Net Worth and Why Does It Matter?

Net worth represents the true measure of your financial health. Net worth is simply assets (everything you own) minus liabilities (all that you owe).

Unlike income, which shows how much money flows through your hands, net worth reveals what you actually keep.

You don’t need a high income to have a positive net worth. What matters more is spending less than you make and investing the difference.

This distinction is crucial because many high earners can have negative net worth if they spend more than they earn.

Your net worth serves multiple important purposes:

- Financial milestone tracking: Monitor your progress toward financial goals

- Creditworthiness assessment: Lenders use net worth to evaluate loan applications

- Investment strategy planning: Guide decisions about risk tolerance and asset allocation

- Estate planning: Understand what you’ll leave behind for beneficiaries

The Essential Net Worth Formula

The basic net worth calculation formula is straightforward:

Net Worth = Total Assets – Total Liabilities

However, the complexity lies in accurately identifying and valuing all components of this equation.

Let’s break down each element to ensure your calculation captures the complete picture of your financial position.

What to Include in Your Net Worth Calculation?

To get an accurate picture of your financial standing, it’s essential to include all valuable assets. Use the list below to ensure that you account for every key asset in your net worth calculation.

| Asset Category | Examples |

|---|---|

| Liquid Assets | Cash, Checking Accounts, Savings Accounts, Money Markets |

| Investment Accounts | Stocks, Bonds, Mutual Funds, ETFs, Cryptocurrency |

| Retirement Accounts | 401(k), IRA (Traditional & Roth), SEP-IRA, Pension Plans |

| Real Estate Assets | Primary Home Market Value, Rental Properties, REITs |

| Personal Property Assets | Vehicles (cars, boats), Jewelry, Art, Collectibles |

| Business Assets | Business Equity, Equipment, Intellectual Property |

Accurately valuing these assets helps create a realistic and actionable net worth figure. Be sure to update these values regularly, especially for investments and real estate.

What Not to Include in Your Net Worth Calculation?

Liabilities reduce your overall net worth, so it’s important to list all debts and obligations. Below are common types of liabilities that should be included in your calculation.

| Liability Type | Examples |

|---|---|

| Secured Debt | Mortgages, Home Equity Loans, Auto Loans |

| Unsecured Debt | Credit Card Balances, Personal Loans, Payday Loans |

| Student Loans | Federal and Private Student Loans |

| Tax Liabilities | Income Taxes Owed, Property Taxes, Self-Employment Taxes |

| Other Financial Obligations | Medical Bills, Legal Judgments, Money Borrowed from Family |

Leaving out even small debts can lead to an inflated net worth and poor financial planning. Double-check all your accounts and obligations to ensure complete accuracy.

Step-by-Step Net Worth Calculation Process

Follow these simple steps to calculate your net worth accurately and track your financial progress over time.

Regularly updating this process helps you stay on top of your financial goals and spot areas for improvement.

Step 1: Gather Financial Documents

Collect recent statements for all accounts:

- Bank statements

- Investment account statements

- Retirement account statements

- Mortgage statements

- Credit card statements

- Loan documents

Step 2: Create Your Asset Inventory

List each asset with its current market value. For real estate, use recent appraisals or comparable sales. For vehicles, consult current market guides for accurate information.

For investments, use the most recent statement values.

Step 3: Document All Liabilities

Record the outstanding balance for each debt. Use the most recent statements to ensure accuracy. Don’t overlook recurring obligations such as student loans, credit card balances, or unpaid taxes.

Accurately listing all liabilities ensures your net worth calculation reflects your true financial position.

Step 4: Perform the Calculation

Add up all asset values, then subtract the total of all liabilities. The result is your current net worth. Use a spreadsheet or net worth calculator to streamline the math and reduce errors.

This calculation gives you a real-time snapshot of your overall financial health and stability.

Step 5: Analyze the Results

Your net worth can be:

- Positive: Assets exceed liabilities (good financial health)

- Zero: Assets equal liabilities (breaking even)

- Negative: Liabilities exceed assets (needs improvement)

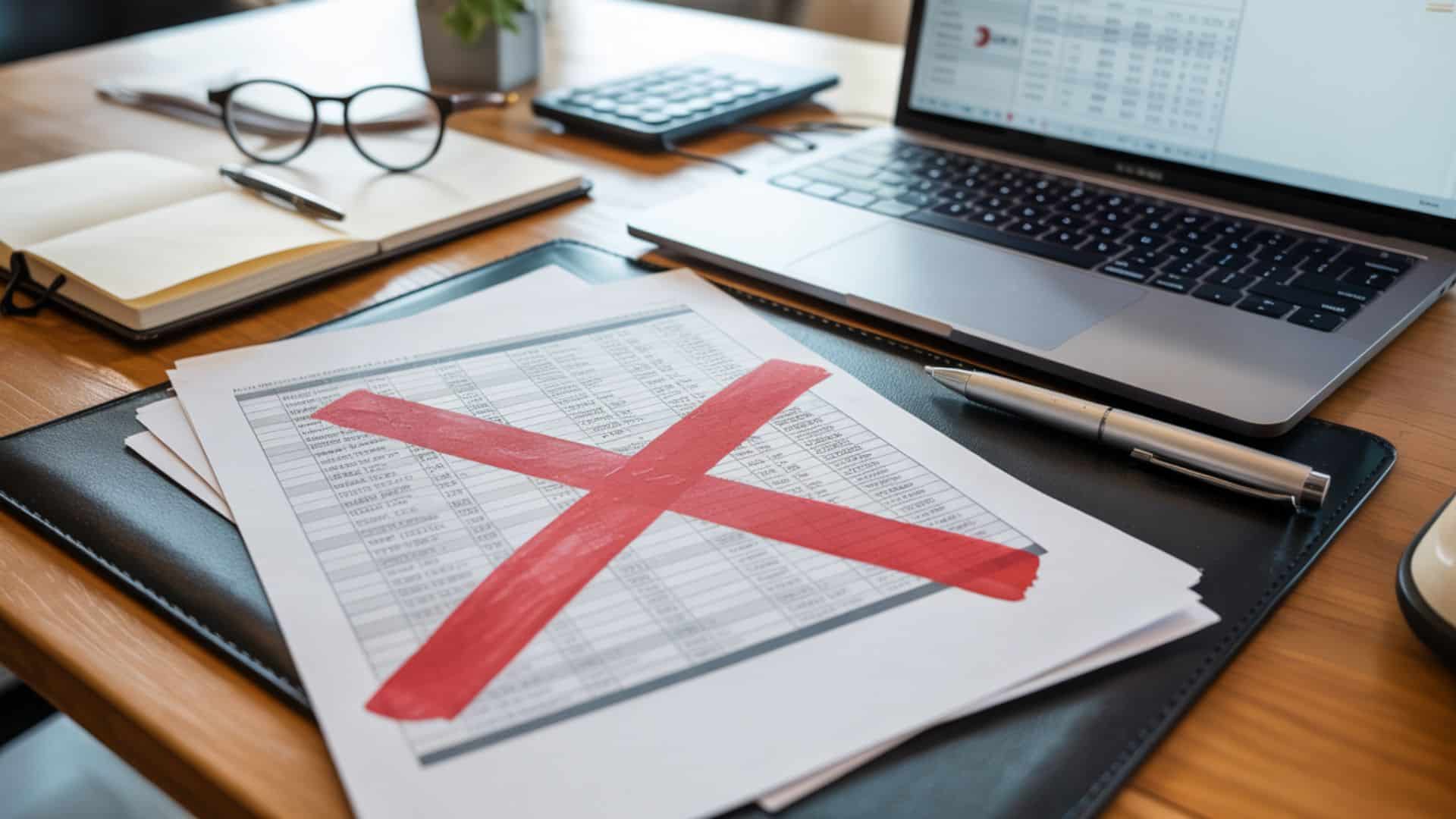

Common Net Worth Calculation Mistakes to Avoid

Avoiding these mistakes ensures that your net worth accurately reflects your financial situation. Accurate tracking helps you make informed decisions and set realistic financial goals.

Overestimating Asset Values: Use current market values, not original purchase prices. Avoid adding items with low resale potential or inflating property values without supporting data.

Missing Liabilities: Include all outstanding obligations, such as credit cards, medical expenses, or personal loans, to ensure accuracy.

Inconsistent Valuations: Apply the same valuation method across all assets and update figures regularly to reflect market changes.

Listing Non-Sellable Items: Only include assets you would reasonably consider converting to cash, not everyday household items.

Using Net Worth Calculators Effectively

Leveraging the right net worth calculator can simplify tracking your financial progress and improve accuracy.

Select tools that provide detailed asset and liability categories, regular updates, and secure data handling for optimal results.

Best Net Worth Calculator Features

When choosing a net worth calculator tool, look for:

- Comprehensive asset categories: Include all types of assets and liabilities

- Regular updates: Ability to track changes over time

- Security features: Encrypted data protection

- Export capabilities: Download or print reports

Top-Rated Net Worth Calculator Options

Empower: This free tool, previously called Personal Capital, is my top pick for tracking your net worth. Other excellent options include:

- NerdWallet‘s net worth calculator

- Schwab MoneyWise calculator

- Bankrate‘s net worth calculator

How to Build Positive Net Worth?

Building a positive net worth requires a balanced approach of increasing assets while responsibly managing and reducing liabilities.

Increase Assets

Build Emergency Savings: Set aside funds to cover unexpected expenses and avoid high-interest debt in the event of an emergency.

Maximize Investments: Contribute to 401(k)s (with employer match), IRAs, and taxable accounts while diversifying your portfolio.

Invest in Real Estate: Consider owning your primary home, rental properties, or REITs to grow long-term wealth

Reduce Liabilities

Eliminate High-Interest Debt: Debt reduces your net worth by increasing liabilities and draining your income through payments.

Prioritize Debt Payoff: Focus on paying off credit cards first, followed by personal loans, auto loans, and finally mortgages.

Manage Debt Strategically: Consolidate high-interest debts, negotiate better payment terms, and avoid unnecessary new debt.

Conclusion

Remember, wealth isn’t about what you can show off. That person you see driving a 12-year-old car could have a $4 million investment portfolio.

Focus on building real, measurable wealth through consistent application of these net worth calculation and building principles.

Your journey to financial success starts with knowing exactly where you stand today.

For more tips and information related to business and money, check our website.