Are you wondering why your credit score isn’t improving, despite making timely payments?

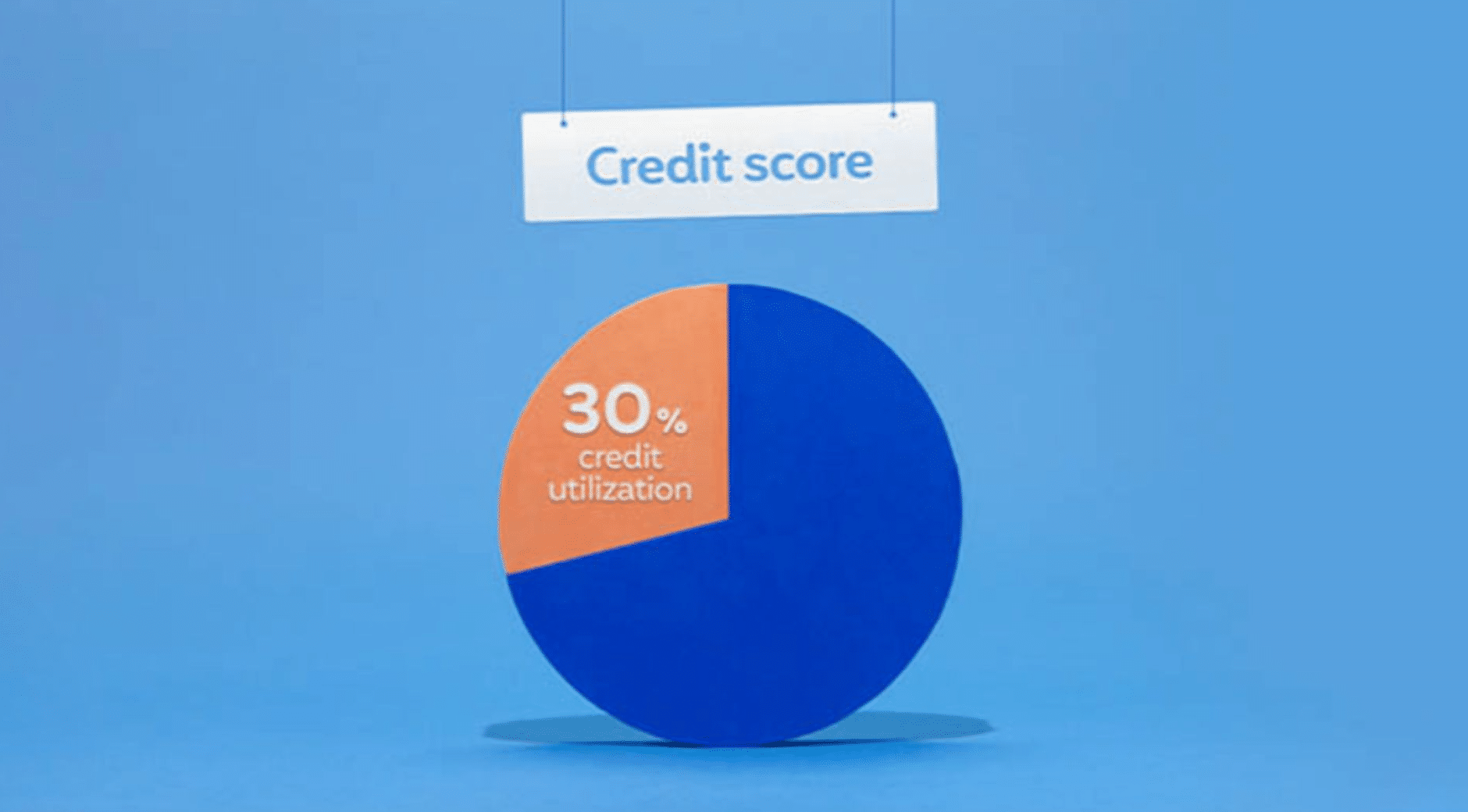

The answer might lie in something called credit utilization – a factor that accounts for 30% of your credit score calculation.

Many people don’t realize how much of their available credit they use can have a bigger impact on their score than they think.

Trying to buy a house, get a car loan, or simply want better interest rates, understanding credit utilization is crucial for your financial health.

What Is Credit Utilization?

Credit utilization is the percentage of your available credit that you’re currently using. It’s calculated by dividing your total credit card balances by your total credit limits, then multiplying by 100.

For example, if you have a credit card with a $1,000 limit and you owe $300, your credit utilization ratio is 30%.

Credit bureaus use this ratio to assess how well you manage credit. It shows whether you’re relying too heavily on borrowed money or keeping your spending under control.

How Credit Utilization Affects Your Credit Score?

Credit utilization is the second most important factor in your credit score, second only to payment history. Here’s why it matters so much:

Impact on Credit Score:

- Accounts for 30% of your FICO credit score

- Can cause significant score drops if too high

- Affects your score within 30-60 days of changes

What Lenders See:

- High utilization suggests financial stress

- Low utilization shows responsible credit management

- Zero utilization might indicate you don’t use credit regularly

The Ideal Credit Utilization Ratio

Most financial experts recommend keeping your credit utilization below 30%. However, for the best credit scores, you should aim even lower.

Comprehending recommended credit utilization rates can help you maintain a healthy credit score and improve your financial standing.

| Utilization Range | Credit Score Impact | Recommended For |

|---|---|---|

| 0-10% | Excellent impact | Best credit scores |

| 11-30% | Good impact | Solid credit health |

| 31-50% | Moderate impact | Average credit scores |

| 51-70% | Negative impact | Credit improvement needed |

| Above 70% | Severe impact | Immediate action required |

The Sweet Spot: Most credit experts suggest keeping your utilization between 1-10% for optimal credit scores.

Types of Credit Utilization

Understanding the various types of credit utilization enables you to manage your credit more effectively.

1. Overall Credit Utilization

This is your total credit card debt divided by your total available credit across all cards.

Example:

- Card 1: $500 balance / $2,000 limit

- Card 2: $300 balance / $1,000 limit

- Overall utilization: $800 / $3,000 = 26.7%

2. Per-Card Credit Utilization

Each individual card’s balance is divided by its credit limit.

Why It Matters:

- Credit bureaus look at both overall and per-card ratios

- Having one maxed-out card hurts your score even if overall utilization is low

- Spread balances across multiple cards rather than maxing one out

How to Calculate Your Credit Utilization

Calculating your credit utilization is straightforward:

Step 1: Add up all your credit card balances

Step 2: Add up all your credit card limits

Step 3: Divide total balances by total limits

Step 4: Multiply by 100 to get your percentage

Quick Formula: (Total Balances ÷ Total Credit Limits) × 100 = Utilization %

Example Calculation:

- Credit Card A: $1,200 balance, $4,000 limit

- Credit Card B: $800 balance, $2,000 limit

- Total balance: $2,000

- Total limits: $6,000

- Utilization: ($2,000 ÷ $6,000) × 100 = 33.3%

Proven Strategies to Lower Your Credit Utilization

Implement these effective tips to maintain a low credit utilization rate and enhance your credit health.

1. Pay Down Existing Balances

The most direct way to improve your utilization ratio is to reduce what you owe.

Action Steps:

- Focus on high-interest cards first

- Make multiple payments per month

- Use windfalls like tax refunds or bonuses

- Consider the debt avalanche or snowball method

2. Request Credit Limit Increases

Increasing your available credit can lower your utilization percentage without requiring you to pay down debt.

How to Request:

- Call your credit card company

- Use online account portals

- Highlight improved income or payment history

- Avoid hard credit inquiries when possible

3. Open New Credit Cards Strategically

New cards increase your total available credit, which can lower overall utilization.

Important Considerations:

- Only open cards you can manage responsibly

- Don’t close old cards after opening new ones

- Be aware of hard inquiries affecting your score temporarily

- Maintain low balances on all cards

4. Use Multiple Cards Wisely

Spreading balances across several cards keeps individual card utilization low.

Best Practice:

- Keep each card under 30% utilization

- Avoid maxing out any single card

- Make payments before statement closing dates

5. Time Your Payments Strategically

Credit card companies report balances to credit bureaus on specific dates, usually your statement closing date.

Timing Tips:

- Pay balances before statement closing dates

- Make multiple payments throughout the month

- Keep small balances rather than paying to zero (1-10% is ideal)

Common Credit Utilization Mistakes to Avoid

Learn the key pitfalls that can hurt your credit score and how to steer clear of them.

| Common Credit Utilization Mistakes | Why It Hurts Your Credit Score | Better Strategy |

|---|---|---|

| Closing Old Credit Cards | Reduces total available credit, increasing the utilization ratio | Keep old cards open, use for small purchases, and set up autopay |

| Paying Off Cards Completely Every Month | 0% utilization on all cards may lower the score | Maintain 1-10% utilization on a few cards, pay others off fully |

| Ignoring Individual Card Ratios | High utilization on a single card can negatively impact the score | Monitor each card’s utilization, keep it under 30%, and spread balances |

Avoid these common mistakes to maintain healthy credit utilization and effectively boost your credit score.

Long-term Credit Utilization Management

Building excellent credit utilization habits takes time, but pays off significantly.

Monthly Habits:

- Check all credit card balances weekly

- Set up account alerts for high balances

- Review credit reports quarterly

- Track your credit score monthly

Annual Reviews:

- Request credit limit increases

- Evaluate whether you need additional cards

- Close cards with high annual fees (carefully)

- Reassess your credit utilization strategy

Conclusion

Credit utilization plays a crucial role in determining your credit score and financial opportunities. By keeping your utilization below 30%, you’ll see significant improvements in your credit health.

Start with one or two techniques that fit your situation, then gradually implement others as you become more comfortable managing your credit.

Your credit utilization ratio can change quickly, which means improvements to your credit score can happen faster than you might expect.

Stay consistent with good habits, monitor your progress regularly, and be patient as the positive changes compound over time.

For more information about markets and finance, visit our website.