Ever wonder why your medical bills seem so confusing? You’re not alone. The U.S. healthcare system puzzles millions of Americans every day.

Between insurance plans, government programs, and medical costs, it feels like you need a degree just to understand your coverage.

Most people are aware that they need health insurance. But few understand how it actually works. What’s the difference between Medicare and Medicaid? How do premiums and deductibles affect your wallet?

In this blog, I’ll show you exactly how U.S. healthcare works. You’ll learn about private insurance, Medicare parts, Medicaid requirements, and the Health Insurance Marketplace.

By the end, you’ll have a clear view of your healthcare options and feel confident making informed decisions about your coverage.

How Health Insurance Works in the U.S.

Think of health insurance like a safety net for medical costs. You pay monthly fees to maintain your coverage. When you need medical care, your insurance helps cover the bills. Key Terms You Need to Know

Premium: Your monthly payment to keep insurance active. You pay this even if you don’t use medical services.

Deductible: The amount you pay out-of-pocket before insurance starts helping. Higher deductibles usually mean lower premiums.

Copay: A fixed fee you pay for specific services like doctor visits or prescriptions.

Out-of-pocket maximum: The most you’ll pay in a year. After hitting this limit, insurance covers 100% of covered services.

Many Americans get help paying their premiums through government subsidies. These work like discounts on your monthly insurance costs.

You might qualify for subsidies if your income falls between 100% and 400% of the federal poverty level, you buy insurance through the Health Insurance Marketplace, and you don’t have access to affordable employer coverage.

The lower your income, the bigger your subsidy. Some people pay as little as $10 per month for coverage.

What is Medicare, and Who Qualifies?

Medicare is the federal health insurance program for individuals aged 65 and older and those with certain disabilities.

The government runs this program to help cover medical costs when you’re no longer working full-time.

You qualify for Medicare if you are 65 years old or older, have certain disabilities, and receive Social Security benefits for 24 months, or have end-stage kidney disease or ALS.

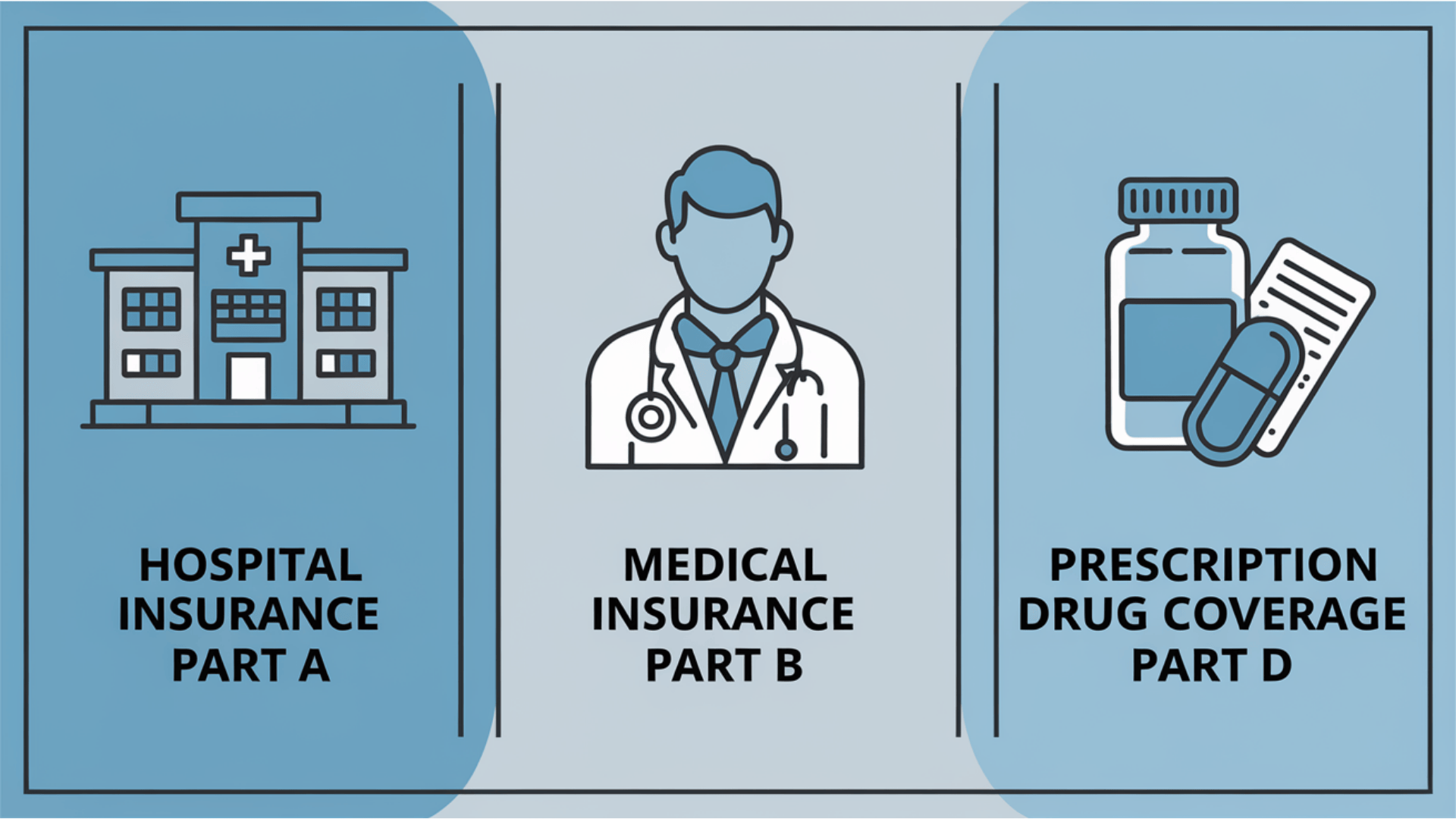

Medicare Parts A, B, and D Explained

Medicare has different parts that cover different services. Think of each part like a separate insurance policy.

1. Medicare Part A (Hospital Insurance)

This part covers your hospital stays when you need to be admitted for serious medical care. It also covers skilled nursing facility care after a hospital stay, home health services, and hospice care for individuals with terminal illnesses.

Most people receive Part A coverage free of charge if they have worked and paid Medicare taxes for at least 10 years. You’ll pay a deductible when you use services, but there’s no monthly premium for most people.

2. Medicare Part B (Medical Insurance)

This section covers your doctor visits, outpatient medical services, and durable medical equipment, such as wheelchairs or oxygen tanks. It also covers preventive services, such as flu shots and cancer screenings.

You’ll pay a monthly premium of approximately $165 and meet an annual deductible before your coverage begins, which helps offset costs.

3. Medicare Part D (Prescription Drug Coverage)

This part helps you pay for your prescription medications at the pharmacy. Private insurance companies run these plans, but Medicare approves them. Your monthly premium depends on which plan you choose and your income level. You can add Part D to Original Medicare or get it included in a Medicare Advantage plan.

Most people start with Parts A and B, then add Part D for prescription coverage based on their medication needs.

What is Medicaid, and How to Qualify for Medicaid?

Medicaid is a joint federal and state program that provides health coverage for people with limited income and resources. Unlike Medicare, which focuses on age, Medicaid focuses on financial need. The program helps millions of Americans access medical care they couldn’t otherwise afford.

Who Qualifies for Medicaid?

Medicaid qualification depends on your income, family size, and the state in which you reside. Each state sets its own income limits within federal guidelines.

You may qualify for Medicaid if you:

- Have a low income based on your state’s requirements

- Are pregnant and meet income guidelines

- Have children under 19 in your household

- Are 65 or older with limited income and assets

- Have a disability that prevents you from working

- Need long-term care services

How Medicaid Varies by State

Here’s where Medicaid gets complicated. Each state runs its own Medicaid program with different rules and benefits.

Some states expanded Medicaid under the Affordable Care Act. These states cover adults with incomes up to 138% of the federal poverty level. Other states didn’t expand, so their income limits are much lower.

In expansion states, a single person earning up to about $20,000 per year might qualify. In non-expansion states, that same person might not qualify at all unless they’re pregnant, disabled, or have children.

The benefits also vary. Some states cover dental and vision care. Others don’t. Some have generous prescription drug coverage. Others are more limited.

The key is to apply in your state to see if you qualify, as the application process is free and requirements can change.

How the Health Insurance Marketplace Works

The Health Insurance Marketplace is like a shopping mall for health insurance plans. You can compare different insurance options, see what they cost, and sign up for coverage all in one place.

The federal government established this system to simplify and enhance the transparency of buying health insurance.

Open Enrollment Dates and Special Enrollment

You can’t buy Marketplace insurance at any time. Enrollment is open at specific times.

Open Enrollment Period: typically runs from November 1 to January 15 each year. This is when most people can sign up for coverage that starts January 1. If you miss this window, you typically have to wait until the following year.

Special Enrollment Periods: enable you to enroll outside of the regular enrollment period. You qualify for special enrollment if you lose your job-based insurance, get married or divorced, have a baby, or move to a new state. You typically have 60 days from the qualifying event to enroll.

How Marketplace Plans Work

All Marketplace plans cover essential health benefits like doctor visits, hospital stays, prescription drugs, and preventive care. Plans are organized into metal tiers that help you understand costs:

| Plan Type | Monthly Premium | Deductible | Best For |

|---|---|---|---|

| Bronze | Lowest ($200-400/month) | Highest ($6,000+) | Healthy people who rarely visit doctors and want basic coverage |

| Silver | Medium ($400-600/month) | Medium ($3,000-5,000) | Most people, especially those getting government subsidies for premiums |

| Gold | Higher ($500-700/month) | Lower ($1,500-3,000) | People who see doctors regularly or take prescription medications |

| Platinum | Highest ($600-800/month) | Lowest ($500-1,500) | People with chronic conditions who need frequent medical care |

The Marketplace also shows you if you qualify for subsidies to help lower your monthly premiums or reduce your deductibles and copays.

Summing it Up

The U.S. healthcare system doesn’t have to confuse you anymore. Private insurance covers your medical costs through monthly premiums.

Medicare helps people 65 and older with hospital, medical, and prescription coverage.

Medicaid serves low-income families, though each state has different rules. The Health Insurance Marketplace lets you shop for plans and get subsidies.

Your age and income determine the best course of action for you. Over 65? Choose Medicare. Low income? Apply for Medicaid. Need private coverage?

Use the Marketplace during open enrollment. The most important thing is getting covered; any health insurance is better than no health insurance.